Ultimate GetVantage Review (Plus Alternatives) [2026]

![Ultimate GetVantage Review (Plus Alternatives) [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/673669c72d859b0c83034071_65b817b240918140228d3025_1234123%20Cropped-p-2000.avif)

2 mins

Global startup investment plummeted 38% year-over-year to $285 billion in 2023, down from $462 billion in 2022. While this decrease was partly due to recession fears, access to growth capital has also become more competitive than ever.

Founders must weigh trading equity for venture capital's cash, leaving startups in need of alternative funding — such as through revenue-based financing (RBF).

In this economic climate, is a platform like GetVantage a viable funding option?

This GetVantage review will cover everything early-stage startups need to know about the company, including pros, cons, requirements–and how some GetVantage alternatives might be a better fit.

What is GetVantage?

Founded in 2019, GetVantage is a fintech startup that offers revenue-based financing in India for small-to-medium-sized enterprises (SMEs) and eCommerce businesses

Rather than traditional loans, they give startups and marketplaces customized access to capital to fuel different business needs, including purchasing inventory and general funding.

This new type of funding allows startups to access capital quicker, giving them time to optimize their cash conversion cycle and scale — without giving away equity.

GetVantage Review

Let’s take a deeper dive into GetVantage’s financing services for eCommerce and SaaS companies in India.

Please note all figures are as of time of writing - January 2024.

GetVantage Description

GetVantage positions itself as a revenue-based financing provider for Indian D2C brands, marketplaces, and SME startups. They aim to deliver customizable, equity-free growth financing for young, high-scaling companies.

GetVantage Founder

The founder and CEO of GetVantage is Bhavik Vasa, an entrepreneur with experience in FinTech, eCommerce, digital payments, and mobile technologies. He also serves on the Boards of other startups.

GetVantage Funding & Investors

GetVantage is backed by Indian and global investors, including Chiratae Ventures, Dream Incubator, Venture Catalysts, and Varanium Capital, among others. To date, they have raised $41 million in funding.

GetVantage Eligibility Requirements

GetVantage offers non-dilutive funding to eCommerce and SaaS companies in India, with no loss of equity or control. Their financing is in the form of a revenue share agreement tied directly to sales.

GetVantage provides funding amounts ranging from $20,000 up to $500,000. Rather than a fixed interest rate, they charge a flat fee on capital deployed.

Repayment terms are customized as a percentage of monthly revenue, scaling up or down aligned with sales. There are no requirements for collateral, personal guarantees, board seats, or equity warrants.

GetVantage Offerings

Loan Types

GetVantage focuses on providing revenue-based financing to digital Indian businesses. They are a platform which connects businesses to capital providers. They offer products including:

Revenue-Based Financing: Their original offering provides flexible growth capital for eCommerce, D2C, SaaS, and other startups. There are no fixed repayments, with amounts paid back fluctuating based on monthly sales performance.

Fixed-Term Loans: For companies wanting more cash flow predictability, fixed-term loans allow customizing a repayment schedule independent of revenue fluctuations.

SaaS Runway Capital: Specific option for B2B SaaS startups to access up to 50% of ARR without dilution, giving companies a “runway.”

Marketplace Seller Financing: Specialized offer for online marketplace merchants needing capital to invest in inventory, marketing, and establishing themselves before major sales seasons.

Application Process

The application process is designed to be fast and seamless leveraging integrations. To qualify, companies should have:

- 12+ months of revenue history

- $6,000+ (₹5 lakh) in monthly sales

- 40%+ of payments processed online

Founders complete an online application. GetVantage will connect to existing platforms like Stripe and Shopify to analyze sales data and verify eligibility. Then, they say the approval decision could be provided “as fast as” 48 hours.

If accepted, funds get disbursed to the merchant’s bank account within 5 days.

Interest Rates & Fees

GetVantage charges a flat fee on the capital advance. This fee varies, but an example on their website advertises a 10% flat fee. To repay, companies share an agreed percentage of their future revenue ranging from 5-25% based on their budget needs. Repayment percentages scale up and down aligned with actual monthly sales performance.

GetVantage automatically collects repayments either via connected payment gateways or bank account debits. Companies also gain access to a GetVantage Visa card and online portal to view transactions.

Source of Funds

GetVantage is a trading platform. This means that the funds they offer to startups are actually provided by a network of ten external Capital Partners - each of whom has their own policies and required rates. This platform approach enables startups to access more financing partners - however, since GetVantage does not control these funds it can limit availability and flexibility of funding for customers.

Recently GetVantage has launched their own NBFC called GetGrowthCapital. They have raised two tranches of funding which they are deploying via the NBFC and other funds.

GetVantage Reviews

There are numerous reviews of GetVantage online - with a positive overall score, and high variance from good reviews to bad reviews.

For instance, one customer spoke of GetVantage’s professionalism and how their experience was seamless:

Others stated that the GetVantage team did not communicate frequently and that their process was delayed. Other customers point out high interest rates.

As with any purchasing decision, potential customers should explore online reviews and speak to current customers to assess if GetVantage aligns with their financing needs.

GetVantage Pros and Cons

Here are some benefits of using the GetVantage platform:

- Provides quick access to non-dilutive growth capital

- Flexible repayments tied to revenue performance

- Ability to scale financing amounts alongside business growth

- Tailored offerings for different verticals and business models

While there are some pros of the platform, GetVantage definitely has some limitations:

- They match customers with external funders - which can reduce reliability and availability of funding

- Lending is restricted to Indian companies

- Funding speed of 5 days is slower than competitors

- Funding amount up to $500k is lower than competitors

- Some negative reviews about employee communication and rates

Top GetVantage Alternatives: Overview

Here’s an at-a-glance comparison chart of some great GetVantage alternatives to consider - with a focus on those serving the Indian market:

Top GetVantage Alternatives: Complete Review

Companies who are doing their due diligence to find the best revenue-based financing companies are looking into GetVantage competitors with lower rates and faster funding speeds. Here is a review of other players offering revenue-based finance in India.

Let’s take a look.

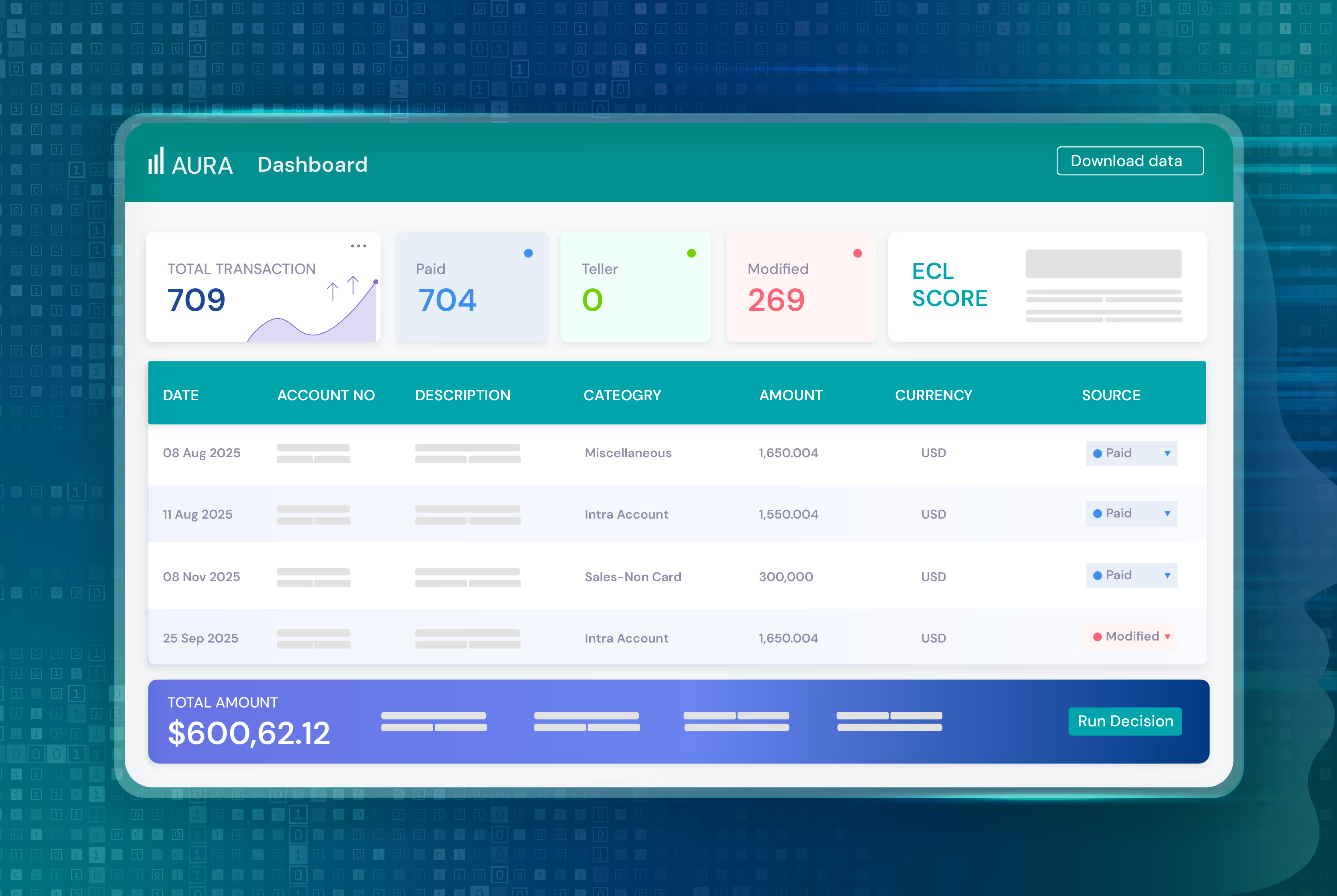

1. Efficient Capital Labs

Efficient Capital Labs (ECL) provides non-dilutive growth capital financing to B2B SaaS companies globally. Headquartered in New York with operations across the US and India, ECL addresses the funding gap for scaling SaaS companies by advancing up to 65% of your projected annual revenue.

Services & Offerings:

With ECL’s revenue-based financing model, you just follow four simple steps:

- You must be a B2B SaaS company, with annual recurring revenue of $100K+

- Fill out an application here through our regular process

- Upon assessment of your application, we’ll come back to you with the offer that you qualify for in INR as well as USD

- Make a final decision. For funding in India (INR), ECL works with NBFC partners

Terms are simple and transparent, and you can see funds within days. Plus, the repayment plan is extremely straightforward — it’ll just take 12 months.

ECL makes it possible to:

- Get incremental funding in 3 days

- Choose an easy 12-month repayment plan

- Start scaling your startup with up to 65% of your projected ARR

ECL’s goal is to build long-term partnerships with SaaS companies, offering transparent and founder-friendly terms for building startups.

2. Recur Club

Recur Club operates an online automated exchange where companies can trade future revenue streams to matched providers for instant growth capital without dilution. They focus on serving high-growth subscription businesses across Asia.

Services & Offerings:

Recur Club advances up to 50% of a company's Annual Recurring Revenue, with the financing limit scaling alongside revenue growth over time. The application process takes around 48 hours and works by syncing data sources for analysis by their algorithms.

Companies repay by sharing a fixed percentage of future subscription revenue over set terms ranging from 6-24 months.

3. Velocity

Velocity is an India-based provider of revenue-based financing for eCommerce and digital businesses seeking growth capital without dilution. They offer alternatives to complex venture capital and bank loans.

Services & Offerings:

Velocity advances funding amounts from $13K to $400K USD through fixed fee revenue share agreements. Companies repay by sharing 5-10% of revenue over terms ranging from six months to two years.

Typically, approvals and disbursals happen within 7 days of the short online application.

4. Klub

Klub offers revenue-based growth financing to consumer-facing businesses and digitally native brands across sectors like fashion, FMCG, food, accessories, apps, and more. Based in India, they provide capital solutions as an alternative to complex debt or equity routes.

Services & Offerings:

Klub provides three core products — Blaze, Gro, and Aceler8 — with funding amounts ranging from $67K to $3M+ USD.

Each option features set repayment terms of 9 months up to 18 months, with fixed revenue share agreements and no hidden fees. Companies repay a multiple of capital deployed and the application process takes one to two weeks.

5. N+1

N+1 Capital provides Revenue-Based Growth Capital financing to emerging companies in India, offering founders alternatives to restricted debt and dilutive equity routes.

Services & Offerings:

N+1 advances amounts ranging from $134K to $1.5M+ USD, with funding up to 4x monthly revenue. Companies repay by sharing a fixed percentage monthly sales over adjustable terms, with continuous access to top-up capital as revenue scales up.

There are no collateral requirements or equity warrants and the end-to-end process takes 1-2 weeks.

Use the Best GetVantage Alternative

For B2B SaaS companies seeking non-dilutive growth capital with greater transparency and exemplary client support, Efficient Capital Labs emerges as the optimal choice.

With vast leadership experience at marquee organizations and funding presence across borders, ECL's matchless global risk model paired with founder-friendly rates creates sustainable partnerships, not just transactions alone.

See how ECL can fuel your venture with long-term flexibility today.

![Ultimate GetVantage Review (Plus Alternatives) [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/675733c091a90dab102096fc_ecl-madeline.avif)