The ECL Journal

Thoughts on capital, growth, and the decisions behind scaling modern companies.

.avif)

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Capital Strategy

Founder Insights

Global Expansion

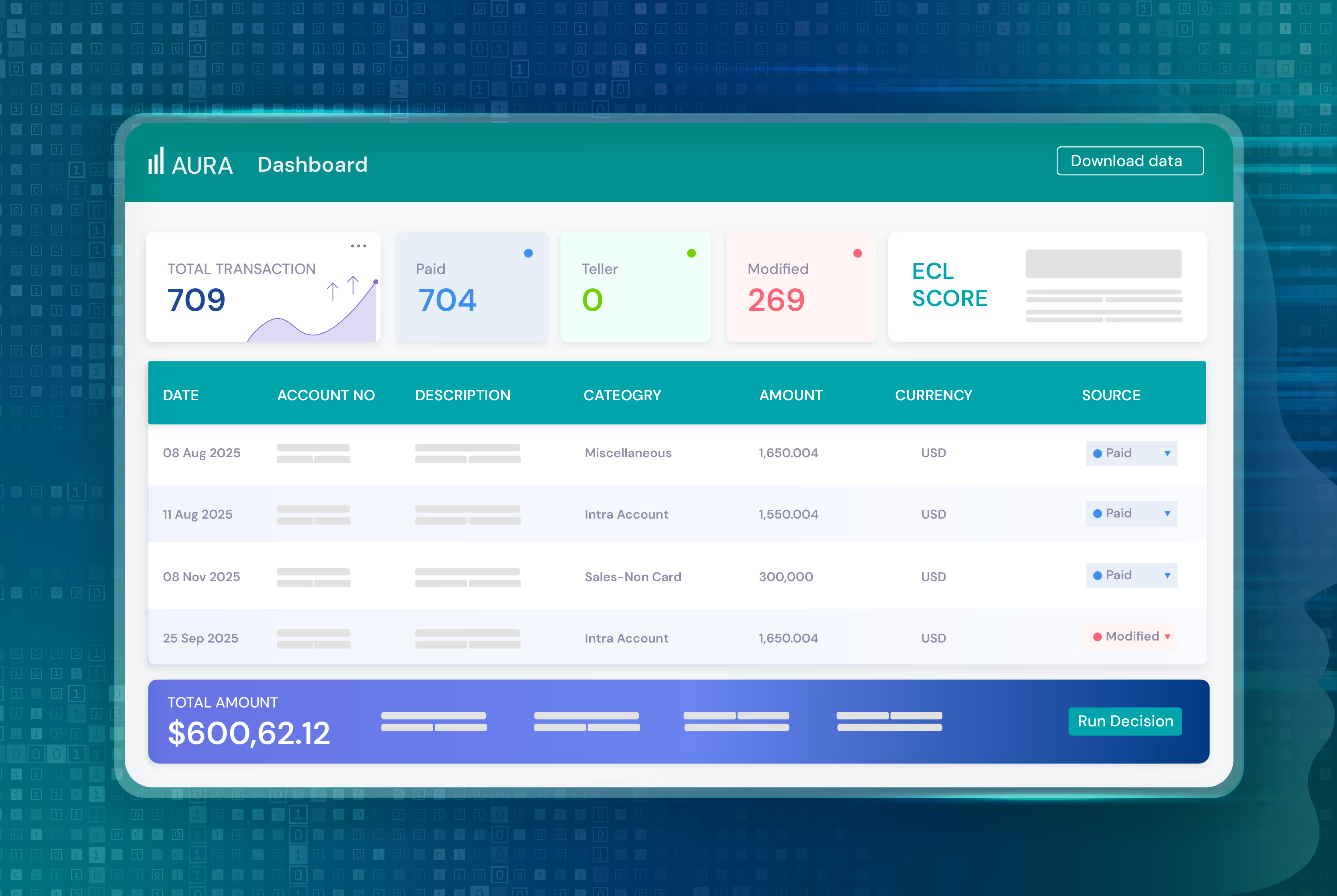

Inside ECL

The Invitation

Founders who drive the future deserve capital that accelerates with them. Let’s make this the most efficient chapter of your story.