How to Use Non Dilutive Financing to Extend Your Startup's Runway

2 mins

Even the most brilliant startups with the best product-market fit will fail if they run out of runway. With the right financial tools, you can make sure it doesn’t happen to you. Bootstrapping is non-dilutive, but it can limit your velocity—and you may still find yourself in a position where you need additional runway growth capital. Equity financing can provide you with a cash infusion, but if overused, it can leave you without control (and limit the upside on your exit).

Enter: non-dilutive financing, the bridge funding alternative that helps founders time their equity rounds to protect ownership without delaying growth.

What is Startup Runway? (And Why It Matters)

Startup runway refers to the amount of time a startup can keep operating before it runs out of working capital, based on its current burn rate. It’s an essential metric for startup founders because it shows how much time you have to hit key growth milestones before needing additional funding. Your cash runway can also provide potential investors with insight into your financial discipline, like how well you manage operational costs, revenue timing, and overall cash flow strategy.

The simple formula for runway calculation:

Cash runway = Available cash / Cash burn rate

How Non-Dilutive Financing Can Extend Runway Without Dilution

Non-dilutive financing is an ideal bridge funding alternative because it gives you the cash you need to hit growth targets and avoids ownership dilution.

This debt financing option is especially appealing to subscription-model SaaS and AI startups because it allows founders to leverage predictable cash inflow to increase their current cash balance. SaaS and AI founders often use Non-dilutive financing for sales expansion, marketing, or product development.

5 Benefits of Non-Dilutive Financing for High-Growth Startups

Here are the top reasons that non-dilutive financing should be part of your startup financing strategy, especially if you’re looking for a longer runway.

1. No Equity Dilution

Avoiding dilution is one of the top challenges for startup founders. On average, founding teams retain just 25% equity at exit. While there will always be a time and a place for equity financing, it shouldn’t be the only tool in your toolbox.

Real-world proof: After a $17M Series B raise, Switch Automation—a tech-driven company helping property owners reduce operating costs and improve energy efficiency—needed a way to respond to changing marketing without impacting growth. Non-dilutive financing allowed them to maintain control while rethinking their growth strategy, allowing them to navigate a challenging market environment and position themselves for continued growth.

2. Quick Access to Capital

When time is of the essence, non-dilutive financing is your friend. Market conditions can change fast, and strategic founders respond just as quickly. When you apply for non-dilutive financing, you can receive an offer in as little as 72 hours.

3. Repayments That Make Sense for Your Business

The funding amount and your repayments are determined based on your monthly revenue, ensuring that the repayment terms and cost of capital align with your business goals.

4. Better Positioning for the Next Funding Round

Make yourself more appealing to venture capital by using non-dilutive financing to hit strategic growth milestones before your Series A, Series B, or Series C. Having a demonstrated track record of success can help you land your ideal investors and negotiate more favorable equity terms.

5. Make the Right Decisions at the Right Time

Non-dilutive financing allows you to expand, hire, and manage operating costs in line with your strategic vision. Non-dilutive financing gives startup founders the flexibility to respond to market changes and achieve optimal velocity. The speed of capital allows you to move quickly, making the moves that will help you grow.

Real-world proof: Cybersecurity company, TechGenies, used non-dilutive financing to hire a Head of Sales and a Head of Marketing Strategy. Both roles were pivotal to the company's growth. As a result, they were able to expand and strengthen their global operations in 10+ countries.

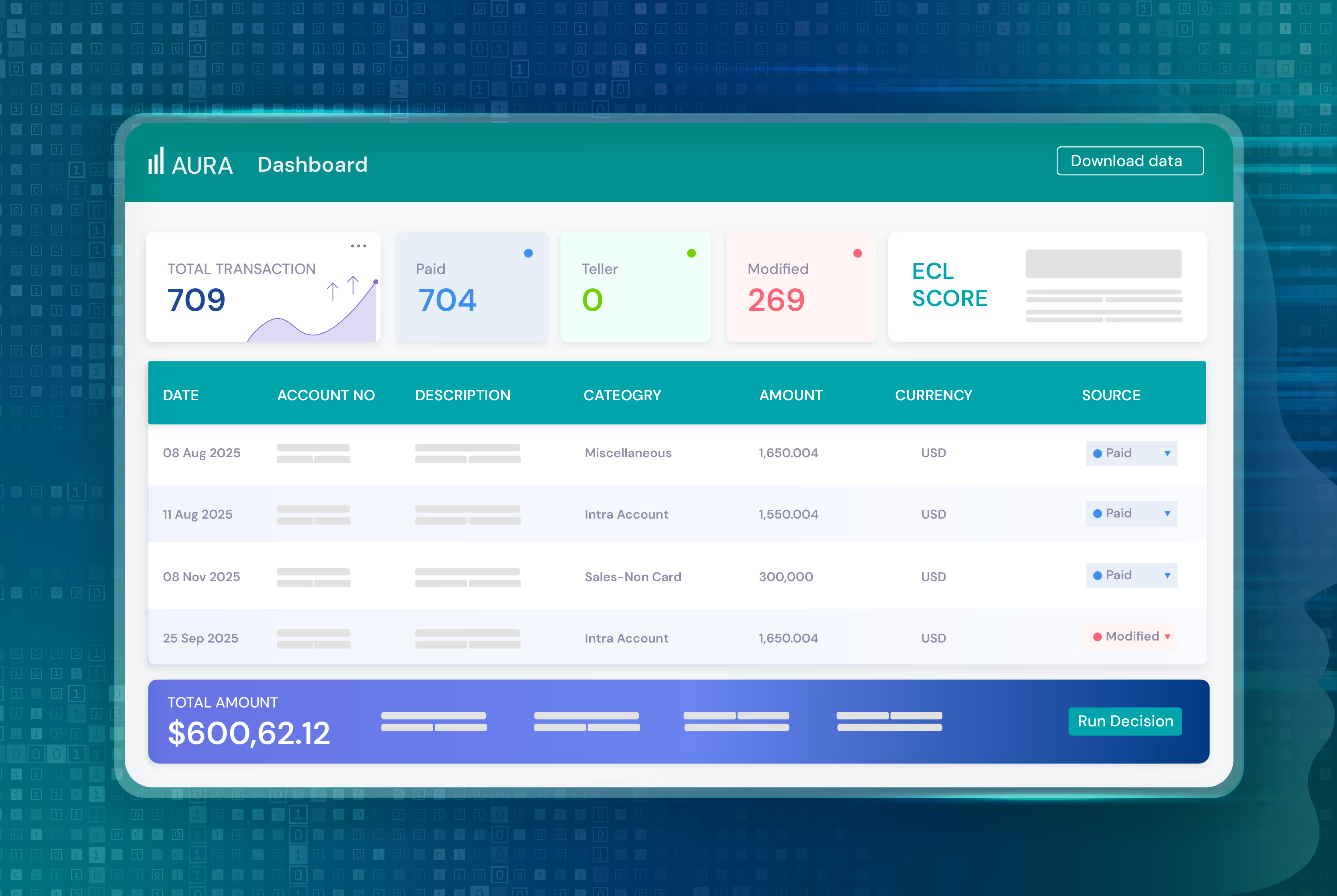

BONUS: Funding for Multiple Markets

For cross-border SaaS and AI startups, getting funding where you need it avoids the added cost of transferring funds into different accounts and currencies. While other funders are limited to single currencies, ECL supports global tech startups with flexible financing in USD, INR, or SGD.

This allows founders to pay vendors and employees in the funded currency, saving time, incurring fewer expensive cross-border money movement fees, and potentially avoiding taxes.

When Should Startups Use Non-Dilutive Financing?

The right moment to leverage non-dilutive financing will vary for each business, and you will likely find it’s a tool you can use more than once as part of your startup funding strategy. Here are some of the most effective times that B2B tech companies and recurring revenue businesses turn to non-dilutive financing to increase their cash reserve.

- When prepping for a fundraise, non-dilutive financing can give you the capital you need to boost growth metrics like your ARR and LTV.

- Funding go-to-market expansion (scaling sales, marketing, etc).

- When you need to cover short-term operating costs or hiring during rapid growth.

- As a flexible alternative to venture debt, when covenants or personal guarantees are undesirable.

- To avoid a down round or bridge dilution in uncertain fundraising environments.

- To smooth out uneven revenue cycles.

- To transition your growth model for long-term, sustainable growth.

Extend Your Cash Runway Now

When you need just-in-time capital, we’re here. ECL makes non-dilutive financing accessible and easy. Complete our online application, and you could qualify for up to $3M in non-dilutive funding. Offers available in as little as 72 hours.

Your runway is waiting. Get started.