Introducing AURA: AI Engine for Smarter Underwriting

2 mins

If you’ve ever tried to underwrite a global SaaS business, you know the chaos that comes with it. Bank statements in multiple currencies, half-readable PDFs, hundreds of contracts, scattered financials, and counterparties that operate across ten different systems.

For years, risk teams have had two options - avoid the chaos altogether, or spend weeks manually reconciling it. At Efficient Capital Labs, we decided to create a third option, the ECL way.

With strong underwriting chops, a clear global outlook and depth of technology know-how, we developed the proprietary Agentic Underwriting Risk Analytics Platform - AURA.

AURA isn’t another dashboard or scoring model. It’s the infrastructure layer that reads, reconciles, and reasons across every kind of financial data, then brings the human underwriter back into the loop at exactly the right moments.

Think of it as an AI assistant for underwriting, one that doesn’t replace judgment but amplifies it.

Why We Built AURA

At Efficient Capital Labs , every lending decision we make depends on understanding a company’s real operating health, not just its ARR headline or a single bank balance.

Our goal was to build a system that sees the entire business, connects the dots across borders, and helps us respond to founders faster, with higher confidence.

AURA does that by bringing together five intelligent systems, each solving one part of the underwriting puzzle.

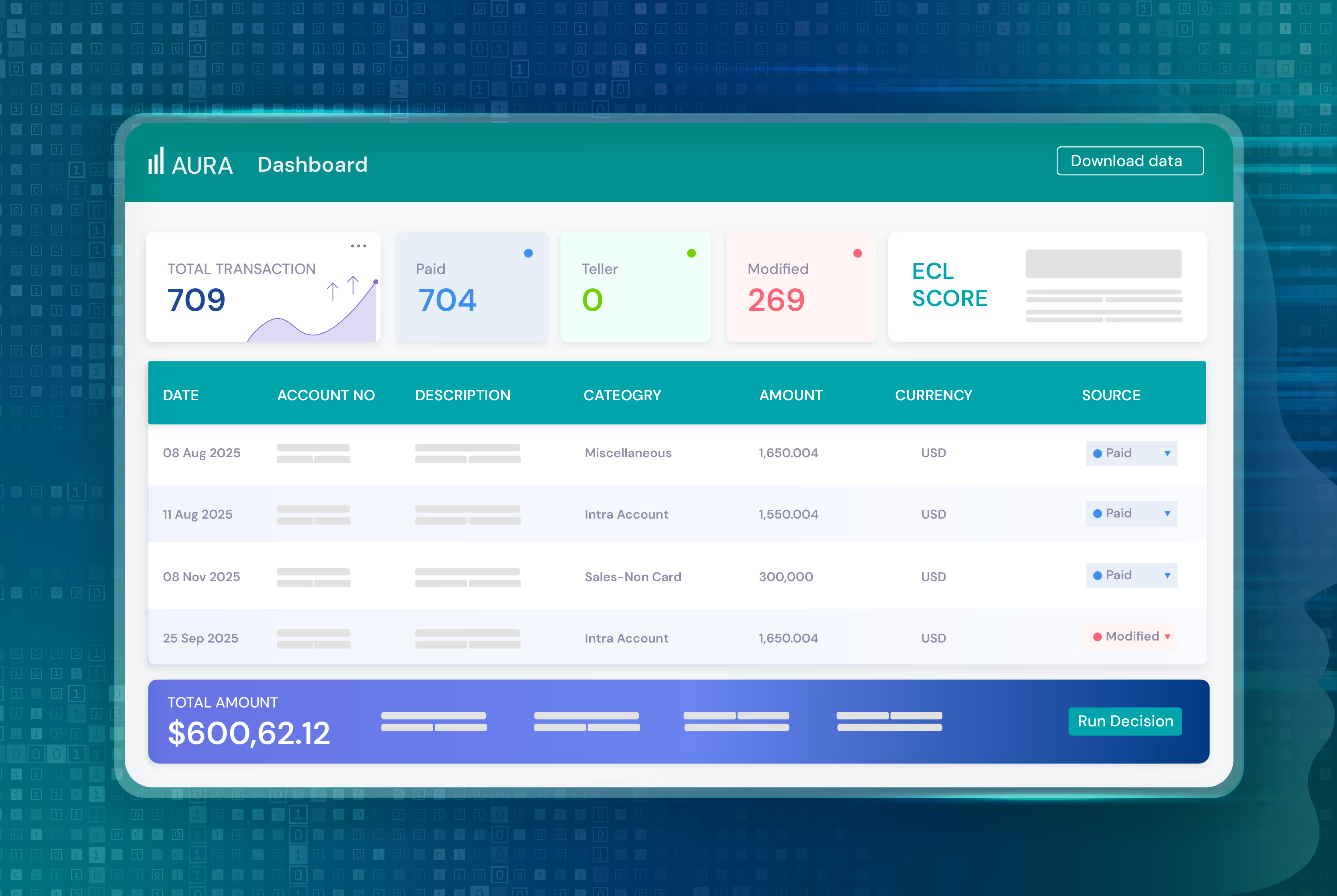

Banking AURA

Where the story begins.

Banking AURA ingests and reconciles bank data in any form - PDFs, statements, or direct API feeds. It standardizes every transaction, identifies inflows and outflows, and normalizes currencies in real time.

The result?

A single, clean, decision-ready dataset that reflects the company’s true cash flow, not just what one statement happens to show.

It also generates an ECL Score and a capacity estimate, giving underwriters a quantified view of repayment ability while keeping full transparency for human validation.

Financial AURA

This is where we make sense of financial statements (income, balance, and cash flow) turning them into structured, comparable datasets. It bridges the gap between static reporting and dynamic business performance, allowing our teams to see trends, not snapshots.

Instead of treating financials as artifacts, Financial AURA treats them as living data.

Contract AURA

Contracts hold hidden insight into how businesses earn, spend, and commit, but they’re also some of the hardest documents to process at scale.

Contract AURA uses AI to parse every clause, payment term, and renewal condition. It maps these into structured fields and flags obligations, dependencies, and risks automatically.

No more buried liabilities or missed renewal triggers, every term is surfaced and searchable.

Counterparty AURA

Every business is part of a network (suppliers, customers, and partners) that collectively shape its stability.

Counterparty AURA analyzes that network. It cross-references public and private data, assesses counterparties’ operational maturity, and creates a risk-adjusted view of the ecosystem.

It’s like underwriting with x-ray vision, seeing beyond the borrower into the environment they operate in.

Decisioning AURA

The brain that brings it all together.

Decisioning AURA integrates signals from banking, contracts, financials, and counterparties to create a unified, AI-enhanced view of creditworthiness.

It doesn’t just output a score, it explains the “why,” the drivers, and the confidence levels behind each signal.

Underwriters can then adjust, validate, or override, keeping human expertise firmly in control.

AI + Human: A Collaborative Future

We’ve built AURA with a clear philosophy, AI should do the heavy lifting, not the decision-making. It can read faster, reconcile cleaner, and spot patterns earlier, but it’s the human underwriter who brings context, empathy, and judgment.

At Efficient Capital Labs, every AI output is reviewed, validated, and explained, because we believe transparency is trust.

What This Means for Founders

For founders, this means faster, fairer funding, decisions made on complete, global data, not fragments. It means capital that understands nuance, like how your India subsidiary supports your US parent, or how multi-currency inflows impact real liquidity.

In short: AI that sees the whole story, not just the spreadsheet.

What This Means for the Industry

For the broader fintech ecosystem, AURA is a proof point.

AI can be deployed responsibly, as an amplifier for human insight. It’s underwriting that scales without losing soul.

AURA is live across all our underwriting systems today, built by a team that understands both risk and engineering.

Massive credit to Amit, Vishak, Thilak, Mandar, Nandeeshwar, and Biprojit Chakraborty — the people turning years of underwriting wisdom into scalable, transparent AI.

This is just the beginning.