The SaaS Founder's Guide to Navigating FX Volatility

2 mins

New markets mean new customers and new revenue streams. Great news if you’re a SaaS company looking to grow. But global expansion comes with the threat of foreign exchange (FX) volatility.

This is not an abstract risk. It is a tangible force with a documented history of negatively impacting business performance. What appears to be a minor financial detail can, in fact, relentlessly erode a company’s hard-won margins and inject a profound level of uncertainty into financial planning. Here’s what you need to know and the steps you can take to mitigate risk.

The Exposure of Global SaaS in Cross-Border Payments

Cross-border payments—vital for everything from subscription billing to vendor payments—are not just a logistical hurdle for global SaaS but a direct source of FX risk. The inherent complexities and time delays in these transactions create a critical window of exposure to currency volatility, making payment efficiency a form of passive risk management.

A standard cross-border payment is a multi-step process that can take several days to complete, and the duration is influenced by factors such as the payment route, the geographic region, and the specific currencies involved. For example, a payment from a U.S. bank to an Indian bank may take 1-3 business days, while other routes can be faster or slower depending on the method and the banks’ processing times.

This time lag, aka “timing difference,” means the exchange rate at the time a customer is billed may be significantly different from the rate at which the funds are finally converted and received, creating an unavoidable source of revenue uncertainty.

The Tactical Founder's Playbook: Strategies to Protect Your P&L

If you want to keep currency fluctuations from eating your profit margins, you need a pragmatic, tactical plan that manages risk without adding unnecessary complexity.

The good news is that you’re in well-trodden territory. A variety of proven strategies exist to help you reduce risk when exporting revenue. From simple operational adjustments to sophisticated instruments and fintech solutions, here are the primary tools for building a tactical FX playbook.

Simple Solutions (Ideal for Early-Stage Startups)

Early-stage startups that don’t require complex financial instruments or that are working without a full-time CFO will rely on natural hedging and dynamic pricing.

Natural hedging is one of the most straightforward and cost-effective ways to tackle FX challenges. This strategy involves aligning a company’s revenue and expenses in the same foreign currencies to create a self-balancing mechanism. For example, if a SaaS company generates a substantial amount of revenue in Euros, it can make a natural hedge by hiring employees or engaging vendors in Europe and paying them in Euros. Then, any loss from a weakening Euro against the base currency would be offset by a reduction in operational expenses.

Dynamic pricing transfers the financial risk to customers by using automated mechanisms that adjust local currency pricing when exchange rates move outside a predetermined range. A key to making this strategy work is communication. Zoom handled this well in 2022 when it raised prices across Europe, partly due to currency shifts. This transparent communication strategy resulted in minimal customer churn.

Advanced & Automated (Ideal for Scaling & Mature SaaS)

As a SaaS company’s international revenue and operational footprint grow, its financial needs become more complex, requiring more sophisticated solutions. A new wave of fintech solutions has made complicated financial instruments more accessible to scaling SaaS startups.

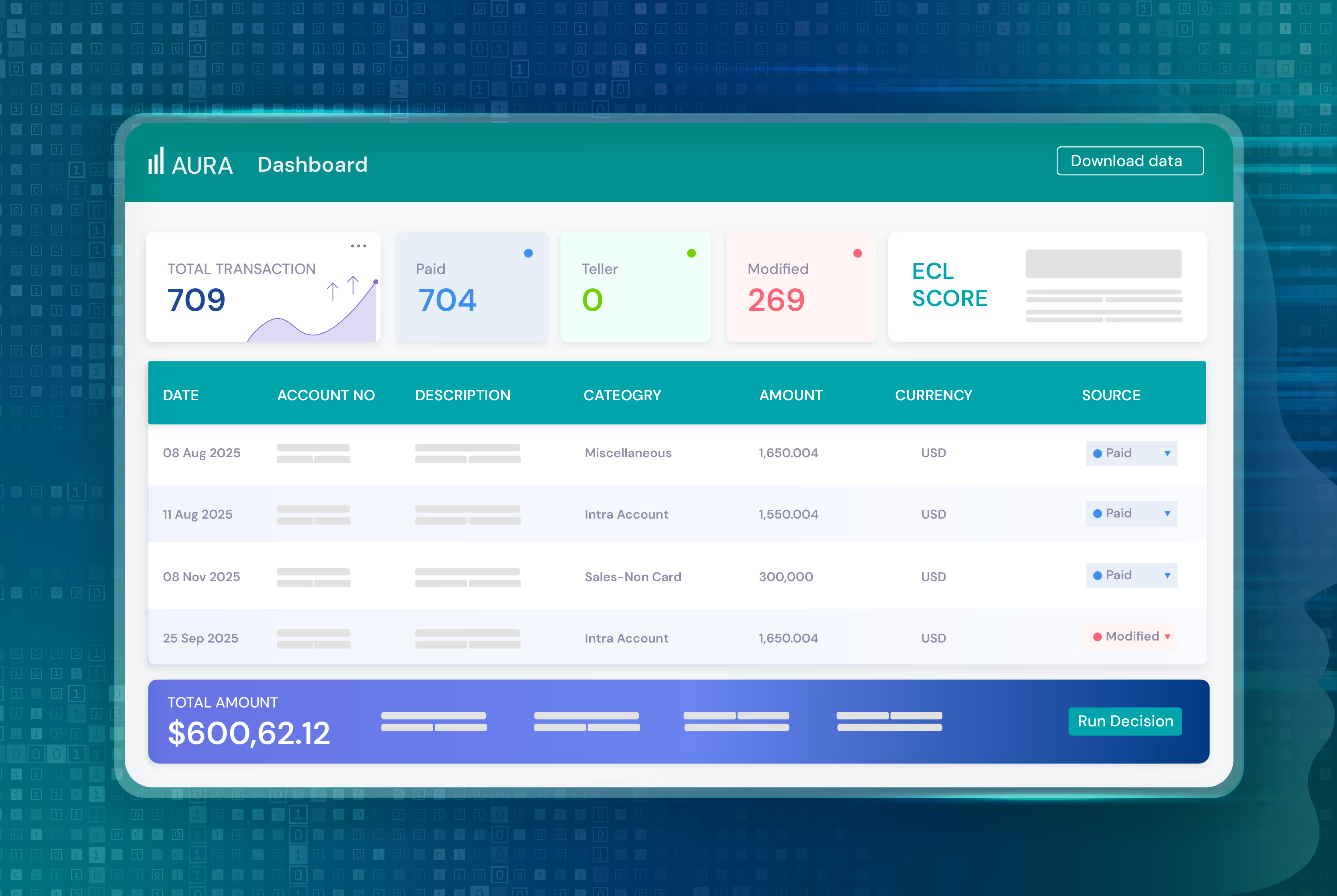

The most significant development in this space is the emergence of a new category of currency hedging startups. These companies, often powered by AI and modern tech stacks, are fundamentally changing how FX risk is managed. Instead of relying on banks and consultants with extensive knowledge (and prone to human error), these AI-powered solutions monitor currency markets 24/7—analyzing risk and automatically executing hedging strategies with transparent pricing and easy-to-integrate APIs.

Now, a global SaaS founder can gain the stability and peace of mind that comes with an institutional-grade FX strategy without the burden of a costly in-house team or navigating the complexities of traditional finance.

Build Your Financial Strength for the Long Haul

Your goal as a founder is to go further than “surviving market fluctuations” and build a financially resilient business. Whether you’re scaling at a rapid pace or seeking funding to navigate a market correction, you deserve a funding partner who understands the challenges of global SaaS inside and out.

At ECL, we’ve helped more than 200 global SaaS founders access the non-dilutive financing they need to achieve their growth goals. Connect with a funding specialist today to see how we can help you do the same.