Bridge Financing for Startups: Definition, Examples, & How Bridge Loans Work

2 mins

As a founder, you may have come across the term “bridge financing” or “bridge loan” recently. Why? Market conditions in venture capital (“VC”) have worsened recently, with S&P Global Market Intelligence reporting deal counts falling 48.2% YoY in 2023 down to 965.

This means that there are fewer opportunities for traditional “Series” or equity-round financing to startups from venture capital investors. As a result, businesses needing access to capital are turning to bridge financing options such as revenue-based financing to help “bridge the gap” between series rounds.

What is Bridge Financing or a Bridge Loan?

In simple terms, bridge financing functions like, well, a bridge! It’s a temporary form of funding used by businesses to cross from one stage of growth to the next. The defining characteristic of bridge financing is the duration of borrowing; bridge financing is short-term in nature, used during a period of change, and subsequently replaced with a long-term solution.

Often, given its shorter-term duration, bridge financing instruments fall within the debt or alternative financing categories as opposed to equity which represents perpetual ownership in a business. In this category, bridge financing may be called a “bridge loan.”

However, bridge financing can also be offered in exchange for a company’s equity.

Companies looking to raise bridge financing can tap a number of different markets based on their size and creditworthiness, including bank loans, revenue-based financing, funding from current investors, and venture debt.

Example of Bridge Financing for Startups

Bridge financing is used by businesses of all sizes, from startups to large public companies.

Startups can see cash flows rise and fall rapidly as their businesses scale. This volatility can present a financing challenge. Let’s look at a hypothetical example where a bridge loan could be a helpful solution for a startup:

A successful startup between its VC Series A and Series B funding rounds may be growing, but tying up all its Series A and operating cash flow into operating expenses. This leaves none left over for new business development and marketing. Closing a new venture capital round raise can take as many as 6-12 months in this environment with both the Company and prospective investors performing their diligence alongside other workstreams.

Moreover, investors want to see the startup meet specific revenue targets before they will commit to the Series B investment.

In this example, the Company elects to take out a three-month bridge loan. They use the proceeds to invest in business development and marketing and achieve an incremental 50% growth in revenue. At the end of the period, the Company pays back the principal and interest on the loan using the additional cash flows. It met the revenue milestones necessary to get the investors on board for the next raise, and closed on its Series B financing.

In this case, the bridge loan was a useful tool as it freed up capital to fund growth and allowed the business to bridge the gap between their Series A and B rounds.

How Bridge Financing Works

Bridge financing works by giving businesses temporary capital during “in-between” phases of growth. In a startup context, this may mean between rounds of series (equity) financing

How Bridge Financing Works in Startup Financing

With this context in mind, let’s take a closer look at how bridge financing can work for startups.

Time between equity rounds: According to data from capitalization table software provider Carta, the median time between equity rounds is 22 months from Seed to Series A, 24 from Series A to Series B, and 27 from Series B to Series C.

Founders know firsthand how quickly time moves in the startup world–but 12 months can feel like an eternity! With nearly two years between rounds for equity financing, bridge financing can help to supplement startups with cash and extend runway as they secure their next round of equity financing.

Flexible capital to support objectives: Given the high degree of operating cash flow volatility, volatility in customer growth, and time between equity rounds, it can be challenging to manage capital as a startup. A lack of capital can constrain the ability to meet business objectives such as sales or market share growth. These strategic objectives can play a meaningful role in equity round valuation.

Bridge financing can assist by allowing startups to access capital to fund growth to achieve objectives between rounds.

Cash runway: Cash runway refers to the amount of time a startup has left, typically expressed in months, before they run out of money and need to raise additional financing. A company’s cash runway is a function of its burn rate, or cash in less cash out per month.

It’s common for startups to be cash flow negative during their growth stage as they build a customer base, invest in fixed assets and R&D for future growth, or use competitive pricing to gain market share as they scale. In these cases, knowing your cash runway is crucial to ensure you have financing lined up to keep the business running.

Companies estimate cash runway in base, upside, and downside scenarios and plan their flagship equity series funding rounds accordingly. Tools such as bridge financing can be used to add flexibility around this timing and “bridge the gap” between rounds.

Access to a different pool of capital vs. VC: The availability of equity capital to startups from the venture complex can ebb and flow meaningfully with market conditions and sentiment. The VC market has seen a meaningful contraction in volumes and sentiment in the past few years from the euphoria of the post-COVID 2020-2021 period.

Broad-based tightening in financial conditions has seen VC firms deploy less capital and at more stringent valuations. Research firm CB Insights reports that Q4 ’23 was the “harshest quarter for global VC in 6 years,” with venture funding falling to $248.4B in 2023, the lowest since 2017. The bridge market offers an alternative pool of capital for startups to tap during pullbacks in VC funding.

Pros and Cons of Bridge Financing

As with any decision, there are pros and cons associated with selecting bridge financing as your funding choice. Let’s explore in more detail to help determine if bridge financing could be the right fit for your business.

Bridge Financing Benefits

- Short-term commitment: Bridge financing is short-term in nature with shorter repayment dates vs. standard bank loans or permanent equity capital. When used correctly, this can be beneficial to startups since they don’t lock into a form of financing that may not be the right fit long term.

- Quick and easy access to capital: In stark contrast to equity rounds which can take up to two years between infusions, bridge financing offers quick and easy access to capital for startups. This can help with one-off cash draws, investments in growth, or runway extension between rounds.

- Different investor base vs. VC: The lending partners in the bridge financing market are generally distinct from the traditional VC complex, with banks and private institutional firms alike lending into the space. This allows businesses to access a different pool of capital during ebbs in VC market sentiment.

Risks of Bridge Financing

- Can be dilutive: Lenders in the bridge financing market face the risk of loss of principal since they are lending to businesses that are running low on cash. The short-term nature of the loans mean interest rates tend to be lower and there is less time to accrue interest. Lenders can seek to be compensated for these factors by requiring equity options such as warrants in their financing agreements. This introduces potential dilution into the funding.

However, not all bridge financing options will be dilutive. The VC and venture debt complex tend to seek equity protection in their instruments and are therefore more likely to be dilutive sources. Alternative finance providers and startup-focused banks such as Silicon Valley Bank can structure non-dilutive arrangements such as revenue-based financing.

- Cost of capital: Given the potential for equity options associated with the bridge financing, on a fully-baked basis the cost of capital can be higher than a simple term loan from a bank. Banks can also provide bridge financing as noted above, however it may include equity options which may raise the cost of capital. It’s important to consider all the terms of the financing to work out the all-in cost of capital and to work with a reputable lender.

- Potential negative signaling effect: Although not set in stone, some may argue there is a negative signaling effect associated with raising bridge financing. Raising a bridge round generally means that the business is running low on cash which could be a result of poor operating performance.

However, this can be mitigated through active and open dialogue with the investor base. For example, a business may see highly profitable growth opportunities but just be low on cash to finance the growth above and beyond their original plan. Bridge capital can allow the business to capitalize on this opportunity and be a net positive in the long term.

Bridge Financing Options

Now that we know what bridge financing is, how it works, and what the pros and cons are, we should be in a good position to know if it's the right financing solution. Let’s explore some of the options for bridge financing below.

Revenue-based Financing

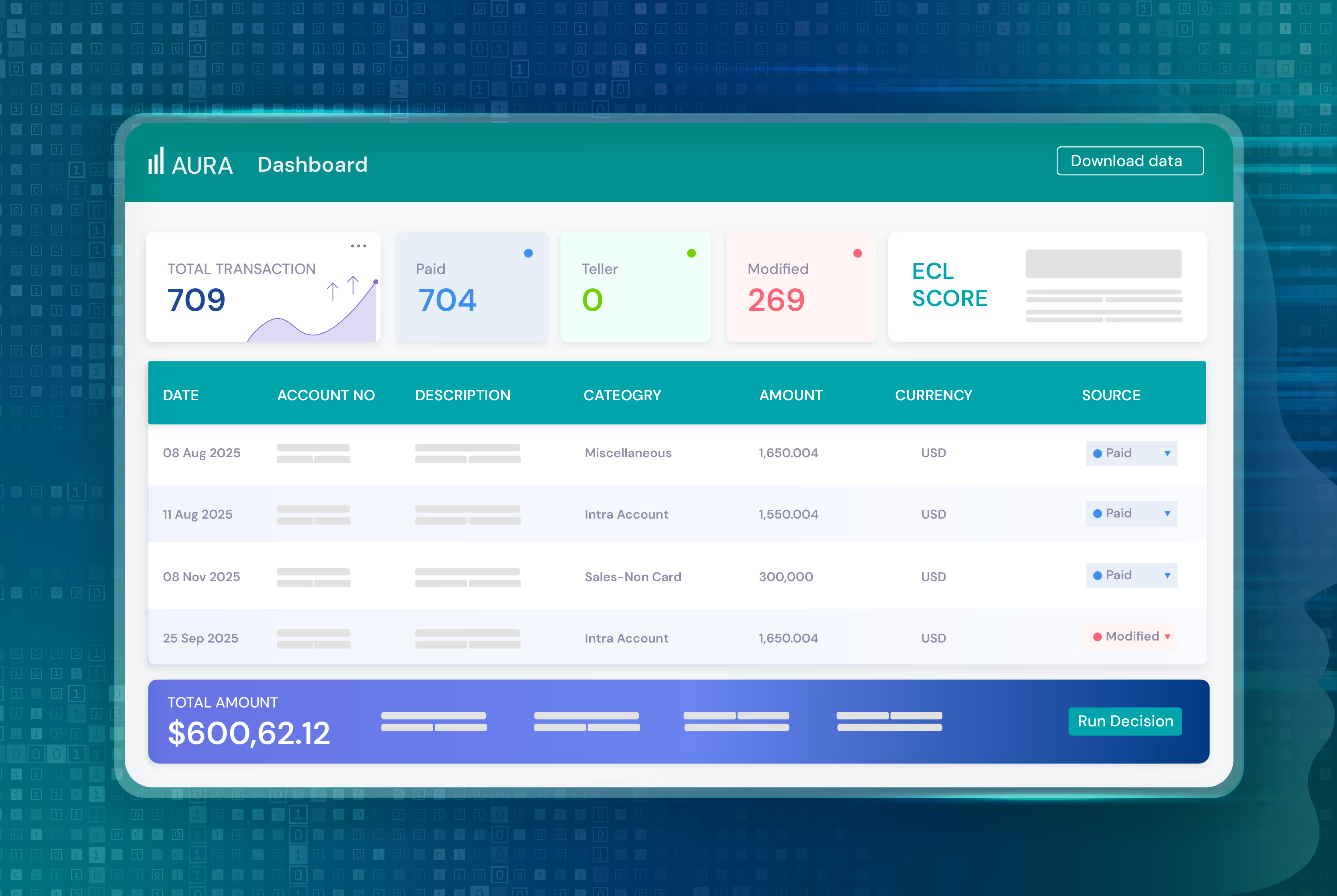

Revenue-based financing (“RBF”) is a type of financing where funding is based on future recurring revenue. This financing model has roots in the US and European markets but has recently begun to resonate in other regions like India, Singapore, and Latin America.

In some cases, RBF works via a percentage repayment of monthly revenues. In other cases, payments are based on predetermined fixed-interest payments. For example, there could be a fixed fee of 10% on a principal of $1,000,000. Each month, the customer pays back an equal fraction of both. So if the principal and fee are equal to $1,100,000 and the term is 24 months, then each month the customer pays back $1,100,000 divided by 24.

Pros:

- No Equity Dilution: RBF allows founders to retain control and ownership. In comparison, venture capital can lead to equity dilution–often upwards of 20% of the company’s shares in each round of financing–and venture debt usually has warrants which allow the lender to purchase shares at a predetermined price.

- Faster Speed of Funding: More traditional funding sources can require due diligence processes that can be incredibly time-consuming. However, because revenue-based financing is based on future recurring revenue, businesses can be funded much more quickly. For example, Efficient Capital Labs offers a rapid, transparent RBF process–providing access to funding within 72 hours.

- No Interest Accumulation: Unlike bank loans and venture debt, RBF doesn’t accumulate interest, providing a transparent and predictable repayment pathway.

- Alignment with Business Growth: RBF investors enable companies to extend their runway on their own growth terms. Alternatively, venture capital financing, for example, comes with growth targets and other requirements that may not align with a founder’s own judgment or goals for the company.

Cons:

- Funding amounts: The maximum funding amounts available through an RBF can be lower than other lending options.

- Requires recurring revenue: Because the lender’s risk sits with future revenue streams, RBF lenders will prefer recurring revenue such as subscription-based contracts to mitigate repayment risk. For SaaS startups, and similar recurring revenue businesses like ecommerce and services startups, which leverage a recurring revenue pricing model, this actually positions them well for this type of financing.

With the right lending partner, you can scale your SaaS business without breaking the bank. Efficient Capital Labs are experts in revenue-based financing and can assist in mitigating these limitations to drive the most value to your business. ECL provides capital in a fast, seamless & cost-effective manner to SaaS Businesses.

ECL has financed over $30M to SaaS startups to date–with over 70% of customers coming back for additional funds.

Bank Loans

Bank loans are one of the most traditional forms of small business financing for which a business secures debt capital from a bank in exchange for fixed interest payments over time.

Pros:

- Fixed terms: The interest rate, amount borrowed, payment due date, and amount repaid are all determined before the inception of the loan, which can make financial planning simpler.

- Low cost of capital: While bank debt may provide a low cost of capital depending on the term of the loan and the risk level of the loan recipient, banks often look for businesses with strong operating and credit histories–which can make this market inaccessible for startups.

Cons:

- Requires operating and credit history: Banks prioritize making loans to low-risk businesses that are looking for longer-term loans. This means that approval rates can be low for early-stage startups which have limited operating and credit history.

- Lack of flexibility: While fixed terms can be a benefit, in a short-term bridge context, servicing fixed payments can be difficult. A SaaS business with recurring subscription revenue may have cash inflows concentrated around certain dates throughout the year which aren’t always in line with interest payment dates.

- Requires assets and collateral: Many banks will require customers to put up assets for collateral, as insurance against the loan not being paid. For startups, particularly in the software and technology space, they may not have any physical assets to use as collateral.

Current Investors

Another option for bridge financing is to tap your current investor base. Depending on what the group of existing investors, or capitalization table, looks like, this may mean drawing from existing VC partners, friends and family, existing bank debt partners, or existing venture debt partners.

Tapping existing investors is a popular method of bridge financing given the existing relationship. Investors in a startup have done due diligence to understand the business and have confidence in it to invest. This makes asking for short-term capital easier. Furthermore, existing partners have a vested interest in the business succeeding which further incentivizes extending additional capital.

The instrument itself could be bank debt, venture debt, or something else. A common bridge instrument when investing from current venture capital investors is a convertible note. In a convertible note arrangement, an existing investor provides capital as a loan which converts to equity at a later date, like the next equity round.

This makes it a natural fit for a bridge as the conversion happens at the “end of the bridge.”

Additionally it aligns startup and investor interests as they seek the highest valuation at the next equity round.

Here we examine the pros and cons of tapping current investors vs. new ones.

Pros:

- Existing relationship: Perhaps the biggest advantage of tapping current investors for short-term capital is that they already know and support your business. Current investors have done their due diligence and like the business and are therefore more likely to partner again. Tapping existing investors allows them to increase their exposure to an asset they like, and for the startup, it saves duplicative diligence and helps with the relationship-building processes.

- Speed to funding: In a similar vein to the existing relationship concepts, the fact that the relationship already exists reduces some of the operational red tape and can allow businesses to access funds more quickly vs. calling up a new lending partner.

Cons:

- Equity dilution: If seeking funding via a convertible note, investors will have the option to convert debt into equity. This can lead to a founder losing ownership.

- Narrower pool of capital: By limiting their search to current investors, founders may be cut off from new pools of capital to borrow from. By reducing competition among lending partners, startups may face higher capital costs as investors do not need to compete for business.

- Investor concentration risk: As a general rule, businesses should seek to put in place diverse and stable funding sources. Tapping your existing pool of investors increases reliance on them and lowers the diversity of funding sources. This can pose a risk if a lending partner can’t make good on their promise.

Venture Debt

Venture debt is a type of debt financing provided by the venture capital complex that has a higher risk appetite than banks and more flexibility in transaction structuring and seniority. Venture debt investors may seek to use bridge financing as an “entry point” into a subsequent round, so founders should understand the transaction structure and think ahead if they may wish to partner with the investor further.

Pros:

- Flexible transaction structures: Venture debt understands the changing needs of startups. Their expertise and capital base allow them to be flexible in structuring terms, which can be helpful in a short-term bridge context.

- Institutional partners: Venture debt providers are investment firms with deep industry and capital markets knowledge. This can make them good partners who understand the underwriting risk and provide well-priced capital.

Cons:

- Higher interest rates: Given their lower position in the capital stack vs. a senior lender like banks, venture debt firms tend to charge higher interest rates to compensate for their higher underwriting risk.

- Could require collateral: Venture debt firms may also add additional protection for their loans by requiring the business to pledge assets that could be sold for the benefit of the lender in case of default. Because this mitigates risk for the lender, it can reduce borrowing costs. However, the encumbering of assets, ongoing collateral reporting, and any legal costs that come with this can be burdensome to a startup.

- May require warrants: Venture debt providers may also seek additional compensation for the risk on their loans, such as through warrants. Warrants can be embedded in financing agreements as additional compensation, giving the lender an option to purchase a portion of the borrower's stock at a predetermined price in the future, making them dilutive to funders.

Bridge Finance for Shorter Term Financial Planning

Typically, startups face the need for a bridge round, when their current runway is expiring. Even though founders raise funds for the next 18-24 months, many events can throw a wrench in their financial plans. These can include the unpredictability of the market, changing customer behavior and the emergence of new competitors.

Bridge finance introduces the option for founders to meet their capital needs in a more flexible and time-adaptive way. In particular, new tools like revenue-based finance are enabling new strategies for founders to plan their cashflow. These strategies enable founders to plan in shorter time frames, time funding around unexpected growth opportunities which may arise, and save costs and equity.

Use the Best Bridge Financing Option

Bridge financing can be an extremely useful tool for startups and when used correctly can fuel incremental growth and have high returns on investment.

Founders have numerous options available to them when considering which option to use, including RBF, bank loans, current investors, and venture debt.

There are pros and cons associated with each option, and it’s critical for the founder to perform an analysis and determine which option is the best for their specific business case.

However, given its short-term and flexible nature, RBF can be an attractive option for founders looking to bridge the gap between series rounds and extend runway.

Efficient Capital Labs can be a valuable partner for you here, providing up to $1.5 million in funding to startups within three days of applying so you can act quickly when opportunities arise.

With ECL, you can:

- Receive up to 65% of your projected revenue as upfront capital

- Extend your cash runway

- Get a better valuation on your next fundraiser

- Access an easy 12-month repayment term with a transparent, fixed annual fee between 10%-12%

- Raise future equity on your terms and timeline

- Complete your last mile to profitability

Calculate your funding eligibility right now