SaaS Funding in India in 2025: A Startup Founder's Complete Guide

2 mins

The Indian SaaS ecosystem has seen tremendous growth over the past few years. As per industry reports, India is the second largest SaaS hub globally, growing at an unprecedented rate.

However, the funding landscape can be complex to navigate for founders who are just starting. The traditional routes of raising capital through equity dilution or bank loans come bundled with their own limitations that may not align with every founder's priorities.

This is where alternative funding models like revenue-based financing (RBF) are beginning to gain traction.

In this comprehensive guide, we simplify SaaS funding for founders by laying out the mechanisms underpinning the major routes to raise capital in India.

What is SaaS Funding in India?

SaaS funding refers to the capital raised by software-as-a-service (SaaS) companies to jumpstart and scale up operations. Major SaaS funding options in India include:

- Revenue-based financing

- Venture capital

- Invoice factoring

- Venture debt

- Angel investors

- Accelerators/incubators

SaaS Funding vs Standard Business Funding

Traditional businesses rely on bank loans, working capital, or internal accruals for funding. However, these are often inaccessible or insufficient for SaaS startups in India that require capital early on to scale tech and acquire customers globally. SaaS startups especially need flexible financing that aligns with unpredictable revenue growth in the initial years.

Startup Funding in India vs Outside of India

While India is the second largest startup ecosystem, startups in India face more restricted access to early-stage capital compared to developed ecosystems like the US. Local bank debt in India usually carries high interest rates of 12-15%.

Additionally, traditional lenders have onerous documentation and collateral requirements, whereas VC funding favors startups who are able to achieve “hockey-stick” growth trajectories in short time frames.

India’s Saas Market

India's SaaS ecosystem has seen tremendous growth, emerging as a leading global hub for cloud innovation.

Rise of SaaS in India

India's SaaS ecosystem has charted staggering expansion over the last decade, with the number of startups ballooning from just around 471 in 2016 to over 26,000 in 2022. The sector has created over $500 billion in value to date, with that number expected to grow to $1.5 trillion by 2026.

Total number of startups in India

Several factors are propelling rapid growth and adoption of SaaS solutions across India:

- Digitalization has accelerated across sectors like banking, retail, healthcare, and education, among others, during the pandemic. This has led to a surging demand for cloud SaaS solutions to drive digital transformation.

- Government initiatives like Digital India and demonetization have provided means towards cashless transactions and online payments, again fueling reliance on SaaS.

- Abundant tech talent combined with a maturing entrepreneurial ecosystem has led to the growth of B2B SaaS startups in India.

Revenue of SaaS in India

The Indian SaaS industry generated a revenue of $10.2 billion in 2022 and is projected to reach $26.4 billion by 2026 according to Statista. Over 70% of SaaS revenue is generated from global sales as Indian companies expand overseas.

Domestic consumption of cloud-based solutions is also surging as businesses across sectors increase their digital adoption. Already 11 Indian SaaS companies have crossed $100 million+ in ARR, including pioneers like Zoho, Druva, Icertis, and Freshworks, as well as new leaders like Innovaccer, Zenoti, and Postman.

Recently Funded SaaS Companies In India

Here’s a list of the recently funded SaaS companies in India (November 2023):

- DuploCloud secured Series B funding, amounting to a total of $49.5 million.

- CapitalOS received Debt Financing, with a total funding of $39 million.

- Vendelux completed Series A funding totaling $17.1 million.

- Doctoryl was financed through Series A, totaling $21.1 million.

- Govly achieved Series A funding, reaching a total of $13.1 million.

- HockeyStack has raised a total of $3.2 million through Seed funding.

- ReturnGO secured Seed funding totaling $11.5 million.

Types of SaaS Funding in India for Startups

A SaaS startup has several options to choose from, including both equity-based and non-dilutive funding in India:

1. Revenue-Based Financing

Revenue-based financing provides funding upfront to SaaS startups, which is repaid over fixed intervals based on future recurring revenues. Companies get access to capital quickly without collateral, equity dilution, or compounding interest. They pay back a fixed fee percentage over a defined term via fixed periodic installments.

Pros:

- Non-dilutive - no equity exchanged

- Swift access to capital within days to weeks

- No collateral required

- Lower cost than equity

Cons:

- Only accessible to revenue-generating companies

- Limited funding amounts compared to sources like venture capital

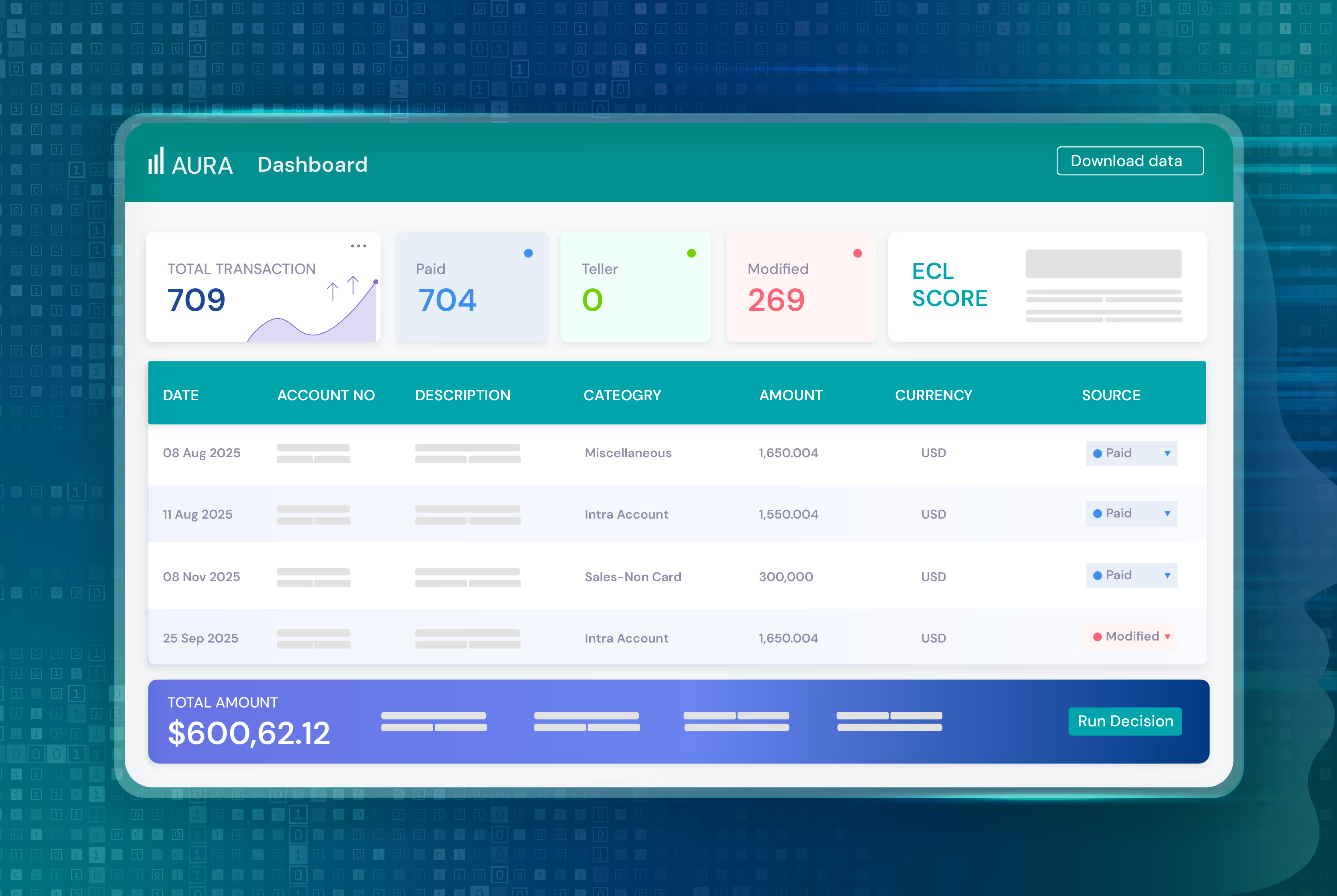

For example, Efficient Capital Labs (ECL) provides revenue-based financing for Indian startups looking to kick-start their journey–without the downsides of traditional funding methods.

Founders can secure funding in three days through a simple application. No hidden fees: just a flat fee rate that you incrementally repay.

With customers ranging from early-stage startups to growth-stage ventures, ECL has a significant presence in funding global SaaS companies. Many of these companies have an operational base in a country like India or Singapore and then generate revenue from other markets like the USA.

ECL has financed over $30M to SaaS startups to date, with over 70% of customers coming back for additional funds.

Get non-dilutive growth capital to scale here

2. Venture Capital

Venture Capital refers to raising investment from VC firms in exchange for an equity stake. It offers access to larger capital amounts but requires sharing ownership. In India, venture capital firms typically target specific sectors or industries as well as seed rounds. For instance, the most funded sectors in India include FinTech ($3.4 billion), B2C ($2.3 billion), Social ($1.7 billion), and EdTech ($1.4 billion).

While Indian venture capital is relatively young, the influx of growth and potential has created more opportunities for startups to obtain venture capital.

Here are some well-known VC firms in India:

- Blume Ventures

- Nexus Venture Partners

- Sequoia Capital

- Kalaari Capital

- Matrix Partners

- Chiratae Ventures

- Elevation Capital

It’s important to note that venture capital funding often comes with significant growth expectations. Many SaaS companies operate in industries with many competitors and a cap on growth. Before taking venture capital, a SaaS founder should consider whether the market they operate in will accommodate the growth required by most venture capital firms.

Pros:

- Ability to raise substantial capital

- Investor expertise and networks

- Higher risk appetite toward startups

Cons:

- Equity dilution leading to loss of control

- High growth expectations

- High cost of capital

3. Invoice Factoring

Invoice factoring allows fast-growing SaaS startups to raise working capital against their accounts receivable or outstanding customer invoices that have not been paid yet.

Invoice factoring is particularly relevant for SaaS companies due to the recurring nature of SaaS invoicing. Depending on payment terms, customers may be paying with delayed terms such as 30-90 days after invoice receipt. Further, customers may pay at irregular intervals, such as annually.

Invoice factoring works by selling unpaid invoices at a small discount to a financing institution to immediately access cash, rather than having to wait for customers to complete payment.

Pros:

- Gain immediate access to working capital from unpaid sales

- Retain ownership and control without equity dilution

- Continue operations without disruption

Cons:

- Higher financing cost than traditional loans

- Requires having substantial unpaid invoices

- Customers are aware invoices have been sold

- May involve the funder becoming involved in the customer payment collections process

4. Venture Debt

Venture debt refers to raising loans from VC firms, financial institutions, or NBFCs designed specifically to fund working capital and operational needs of startups backed by equity investors. It works by structuring a loan that gets paid back with interest over a period of 3-5 years.

Today, there are over 50 venture debt funds in India. Out of all Indian funding, it makes up just under 5% of the total startup capital deployed (January to June, 2023).

Here are some big funds:

- Alteria Capital

- Lighthouse Canton

- Innoven Capital India

- EvolutionX

- Grand Anicut Fund

- Nuvama Asset Management

- BlackSoil

Pros:

- Complementary source to expand growth capital

- Interest rates often lower than equity cost

- Leverage equity round traction

Cons:

- Needs existing venture capital support

- Usually requires warrants diluting equity

- May require assets as collateral

- Higher rates than bank loans

5. Angel Investors

Angel investors are high-net-worth individuals who provide funding to early-stage startups in exchange for an ownership stake. Angels invest their own money and often have entrepreneurship experience.

They fill the gap between founders’ personal capital and formal VC rounds by providing smaller seed-stage capital injections. While not as plentiful as venture capital yet, India has seen an influx of angel investors looking for investments.

Pros:

- Get backing from successful founders

- Tap into expertise and networks

- Bridge to larger VC rounds

Cons:

- High ownership percentages

- Informal agreements

- Limited check sizes

6. Accelerators or Incubators

Accelerators and incubators offer early-stage startups seed funding, mentoring, and access to networks for a fair equity share. Essentially, incubators are similar to angel investors yet come with organized programs, allowing startups to rapidly scale under expert guidance.

In India, there are several incubator programs for startups as the market rapidly grows.

Pros:

- Seed capital and structure

- Mentorship and connections

- Investor access

Cons:

- Extremely competitive entry

- Equity stakes to join the programs

- Fixed timeframes for mentorship depending on the institution

Funding Rounds for SaaS Startups to Know

It's crucial for founders to understand the typical funding rounds that SaaS startups progress through as they scale. Here are the funding rounds to consider:

Pre-seed

Pre-seed funding is the initial capital raised to finance product development and market validation before formal incorporation. The typical range is $10k to $150k from founders, friends and family. Amounts may be greater and range into the millions ($), particularly if pre-seed funding is supplied by an angel investor or early-stage venture capital firm. At this stage, the emphasis is on lean operations with minimal expenditures, aiming to stretch every dollar to its maximum impact.

Seed

Seed funding kickstarts full-scale operations by financing hiring, product enhancement, and initial marketing. Typical range is $500k to $2 million from angel investors, incubators, and seed funds.

This phase is about transitioning from concept validation to initial operations, including refining the product, building a team, and launching marketing initiatives.

Series A

Series A funding scales growth by financing sales expansion, new market entry, and operational infrastructure. With a proven product and some market traction, the focus shifts to expanding the customer base, entering new markets, and building out the operational infrastructure to support growth. The typical range is $2 to $15 million from VCs.

Series B

Series B funding aims to spur rapid growth by financing technology, talent, product development, and marketing. With an established product-market fit and a growing customer base, the emphasis is on scaling the business to dominate the market.

This involves significant investments in technology, talent acquisition, and marketing. Typically, the range is $10 to $60 million for a Series B funding round.

Series C+

Series C and beyond represent maturity stages in a startup's lifecycle, focusing on scaling the business to new heights. This includes expanding into new markets and geographies, possibly through acquisitions, and preparing the company for a future liquidity event.

Rounds size increases substantially, often $50 to $100 million plus, including from venture capital firms and larger investors.

IPO

An Initial Public Offering (IPO) offers a pathway to access public markets for capital while providing early investors with an opportunity to realize gains. The IPO process involves selling shares of the company to the public, often resulting in a significant influx of capital that can be used to fuel further growth, innovation, and expansion.

Metrics Investors Look at in SaaS Funding in India

Investors scrutinize specific metrics to gauge the health and potential of SaaS startups in India. These indicators provide insights into a company's performance, sustainability, and growth prospects.

ARR or RRR

Annual Recurring Revenue (ARR) or Regular Recurring Revenue (RRR) are essential metrics, showcasing the predictable income generated from subscriptions annually. It reflects the startup's stability and growth trajectory, with investors favoring a high and steadily increasing ARR.

MRR

Monthly Recurring Revenue (MRR) is crucial for understanding the monthly earnings from subscriptions, offering a more immediate view of financial health. Consistent growth in MRR indicates a strong market demand and effective customer acquisition strategies.

Churn Rate

The churn rate measures customer retention, indicating the percentage of subscribers who cancel their services. A low churn rate signifies customer satisfaction and product stickiness, critical for long-term success.

ARPU

Average Revenue Per User (ARPU) assesses revenue generated per customer, highlighting the value derived from each user. Higher ARPU indicates effective monetization strategies and a potentially lucrative customer base.

CAC

Customer Acquisition Cost (CAC) quantifies the expense of gaining a new customer. Investors seek a low CAC relative to ARPU, as it suggests efficient marketing and the potential for scalable growth.

Gross Margin Percentage

This metric reflects the profitability of a SaaS company, excluding costs like sales, marketing, and administration.

YOY Growth

Year-Over-Year (YOY) Growth rates compare annual performance metrics, providing insights into the company's growth pace.

More About SaaS Funding in India

India's SaaS sector is booming, drawing attention globally for its innovative solutions and rapid growth. Here are some common questions about SaaS funding in India.

Which city is the SaaS capital of India?

Bangalore, often dubbed the Silicon Valley of India, stands as the country's SaaS capital. Renowned for its dynamic startup ecosystem, it hosts a plethora of Indian founders, from burgeoning startups to established giants, benefiting from a rich talent pool and a vibrant tech community.

Which other cities are SaaS hubs in India?

Aside from Bangalore, cities like Chennai and Hyderabad have emerged as significant SaaS hubs. Chennai, in particular, has gained recognition for its dense concentration of SaaS startups, with the SaaS organization SaaSBoomi created there.

Is India the next global SaaS capital?

With India rapidly growing in population and technological advancement, growing to number two in the world for SaaS startups, it very well could be the next global SaaS capital. The only potential hindrance to this expansion could be limits in capital available to startup founders.

But with other methods like revenue-based financing, this problem could be solved.

Future Predictions for India’s Saas Market

- India could very well lead global SaaS within the next decade if the thriving startup ecosystem continues receiving investments.

- Over 100 Indian SaaS startups will cross $100 million valuations, and 25 will cross $1 billion valuations by 2030.

- The abundance of world-class engineering talent in India will power innovation and efficient product-building.

- Rising global competitiveness around AI and intelligent automation will play right into the hands of India's top-notch talent.

Revenue-Based Financing to Fund India’s SaaS Companies

As India's SaaS ecosystem grows from strength to strength, innovative funding models like revenue-based financing are proving to be a game-changer, aligning with the needs of founders.

Efficient Capital Labs is at the forefront of providing swift, non-dilutive growth capital to Indian SaaS startups via its fast underwriting and customized offerings.

ECL empowers entrepreneurs to fuel their visions of building the next SaaS unicorns out of India without external influence or loss of control. You can fine-tune US and India borrowings for extended dual-country cash flow so you can access truly borderless financing.