Best Startup Loans for Businesses in 2025

2 mins

Startups have many options available to them for financing a new business venture across the traditional and alternative financing spectrum. A common strategy is to begin by bootstrapping or using your own capital, to get your business up and running.

This can be a simple and easy place to start, however as the business grows, founders may need access to additional funding. The next step for an early-stage business can be to take out a startup loan.

What exactly is a startup loan–and which is the best for your business? This guide will cover everything you need to know.

What are startup loans?

The phrase startup loan does not refer to a specific type of financial instrument but rather is a generic term for non-equity financing for early-stage businesses. Startup loans are generally characterized by: early-stage borrowers, no equity exchanged, riskier for lenders, smaller in size vs. traditional bank loans, and shorter in tenure vs. traditional bank loans.

Startup loans can come in the form of standard debt financing instruments such as bank loans, lines of credit, and equipment financing, or alternative financing such as revenue-based financing or invoice factoring.

Startup business loans vs traditional business loans

The difference between a startup business loan and a traditional business loan generally lies in the characteristics of the borrower. The borrower is an earlier-stage, riskier business relative to a more traditional, mature company. As a result, lenders seek to mitigate their risk by limiting loan size and tenure.

Additionally, in some cases and geographies, governments and/or government-affiliated agencies will offer credit risk-subsidized or tax-advantaged startup loans to support small businesses. In the United States, this program is facilitated by the U.S. Small Business Administration (“SBA”).

What to Know About Loans in the Startup Growth Cycle

In startup parlance, the growth cycle for early-stage businesses is often defined by its point in the equity fundraising cycle. The cycle begins at Seed, then Series A, B, and C (sometimes D and E), followed by an initial public offering or (“IPO”).

Equity rounds are considered larger milestones given that outside capital is underwriting growth and signifying belief in the underlying business. However, equity financing is expensive because it requires founders to give up a percentage of their business. Raising non-equity financing is an important part of business growth.

Startup loans are generally used in early-stage (think: seed, Series A) growth phases to finance business growth before the company has adequate operating history and financial performance. After this, the startup can tap the traditional bank loan, venture debt, and private credit markets. Loan sizes can vary from low five figures to low, single-digit millions, depending on company size and lender.

To contextualize further, a recent small business loan report from Forbes notes that in their Survey of Terms of Business Lending, the Kansas City Fed reports an average small business loan is approximately $663,000.

Startup loans are often used in conjunction with venture capital and can be taken out together with venture financing or in between rounds.

The use of startup loans varies by industry. Business models that are balance sheet or capital-intensive businesses such as financial technology, property technology, or industrial manufacturing may seek startup loans given the amount of capital required to run the business.

Meanwhile, a capital-light business like software-as-a-service (SaaS) or advisory requires less capital to start . However, this type of business may lack the collateral needed to access a traditional bank loan, and may explore alternative types of startup loans.

Best Startup Lending Types

Founders of early-stage businesses have many options available to them when looking to raise funding outside of the traditional venture capital equity market.

The instruments below span the traditional debt and alternative financing spectrum, and each carries different characteristics with distinct advantages and disadvantages.

Below we will explore options for startup loans and their pros and cons to help founders determine which instrument is the best fit for their business.

1. Revenue-Based Financing

Revenue-based financing is a fundraising arrangement in which a borrower receives dollars today in exchange for a repayment from revenue earned in the future. The amount is negotiated up front as a fixed fee or a percentage of monthly revenue, and the loan is repaid over time as revenues come in.

This financing model grew predominantly out of the US and European geographies. However, additional markets are growing in India, Singapore, and Latin America and are beginning to leverage the structure as well.

Pros:

- Efficiency in Financing: Securing RBF is generally faster and involves fewer obstacles relative to other funding methods. Providers of RBF are capable of disbursing funds in a remarkably short period, ranging from just three days to a maximum of two weeks.

- No Asset Requirement: RBF doesn’t require companies to put up assets as collateral, reducing the risk and keeping assets secure. There’s also no exchange of equity.

- Better Alignment with Business Growth: While VC funding often comes with growth targets and other requirements that may not align with a founder’s judgment, companies that use RBF can extend their runway on their own growth terms.

- No Interest Payments: Other forms of startup loans such as bank loans or venture debt often accumulate interest. RBF does not accumulate interest, providing a more predictable repayment pathway with a transparent and predetermined fee for the funding.

Cons:

- Capital Cost: Revenue-based Financing (RBF) may offer greater flexibility, but it can also lead to higher overall financing costs compared to traditional bank loans, especially for large, established companies that can secure low-interest loans or access public bond markets. However, this is less of a concern in the startup space, where these businesses generally do not have access to those markets given their size.

- Requirement for Existing Revenue: RBF is based on a company's revenue, making it a viable option only for startups that are already generating income. Startups without a product or revenue will not be able to tap the RBF market.

Founders looking to leverage the many benefits of RBF should work with Efficient Capital Labs.

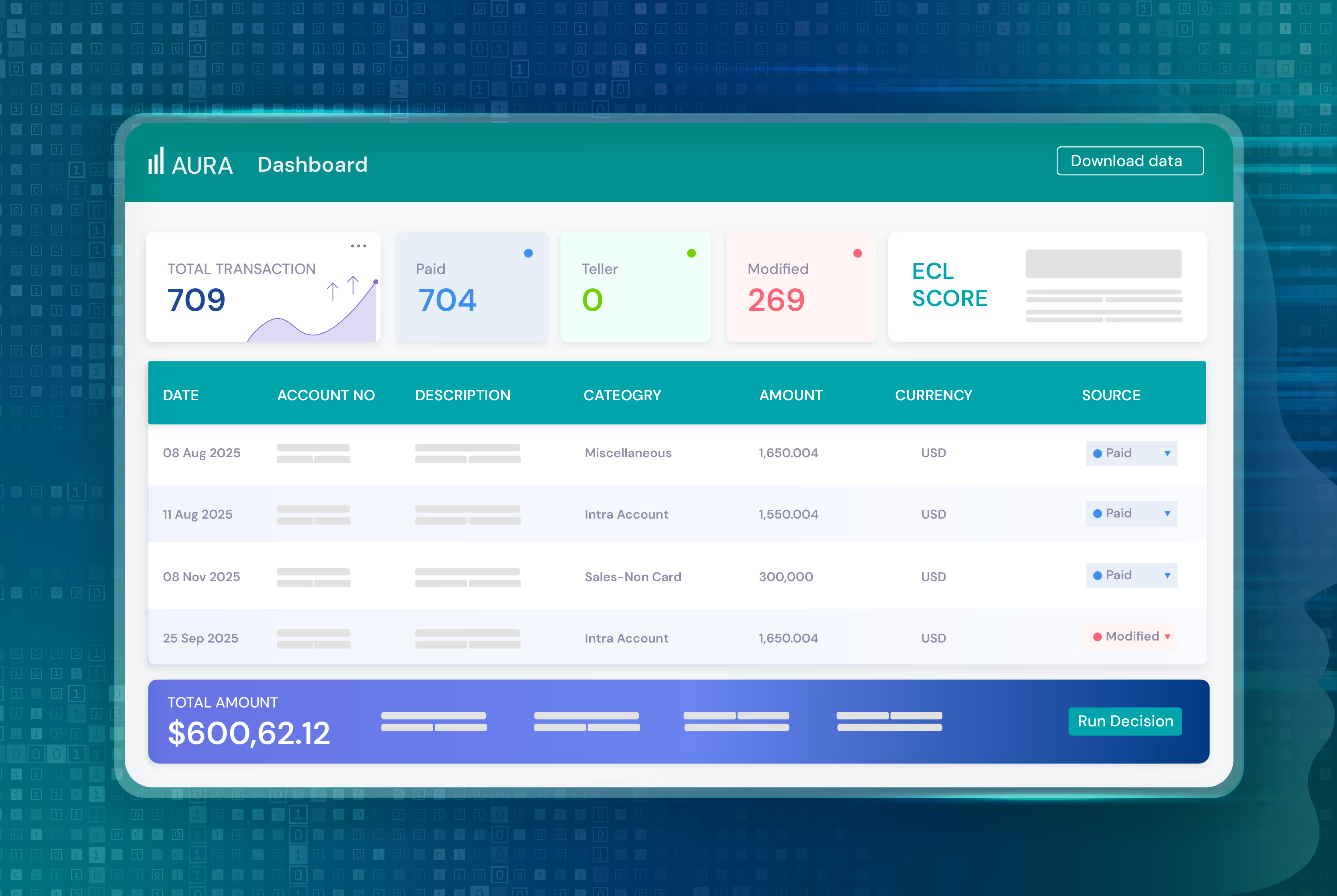

ECL is a revenue-based financing provider that offers advisory and funding to startup companies. The platform serves B2B SaaS businesses that earn global revenue, particularly from the US and other major markets.

Many customers have a product and operations base in a separate country, like India or Singapore.

With ECL, you can:

- Receive up to 65% of your projected revenue as upfront capital

- Access an easy 12-month repayment term with a transparent, fixed annual fee between 10%-12%

- Raise future equity on your terms and timeline

- Get a better valuation on your next fundraise

2. SBA Loans (Small Business Administration)

For startups based in the US, SBA loans are an interesting option to consider. The US Small Business Administration (“SBA”) was created in 1953 to facilitate the flow of financing to small businesses in the United States. It is a broad-based resource for small business owners to plan, launch, manage, and grow their businesses. The SBA works with lending partners to provide loans to small businesses by setting guidelines for loans and reducing lender risk.

The SBA does not directly make loans, but will “guarantee” or stand behind loans made to small businesses to reduce credit risk to the lender, making capital more available and at lower costs.

Per the SBA website itself, there are many pros to SBA loans:

Pros:

- Lower cost of capital: SBA-guaranteed loans generally have rates and fees that are lower or comparable non-guaranteed loans. By guaranteeing the credit risk associated with the underlying business, the SBA allows banks to offer lower-cost instruments.

- Borrower support: In addition to facilitating capital flow, the SBA provides continued support to borrowers to help them start and run their businesses.

- Favorable terms: SBA loans are structured to help small businesses; they often come with favorable terms relative to regular bank loans such as lower down payments, flexible overhead requirements, and no collateral needed for some loans.

However, there can also be some limitations:

Cons:

- Lengthy Approval Process: The SBA sets guidelines to raise financing. The application and approval process can be time-consuming and tedious, which can result in slower speed to funding.

- Strict Eligibility Criteria: The government set specific eligibility requirements for loans, and not all businesses will qualify. Factors like industry type, company size, and financial history can affect eligibility. This can make it difficult for some businesses to be approved for an SBA loan.

Despite these limitations, the SBA is a great starting point and is accessible for all types of businesses. The SBA seeks to support all small businesses from physical asset businesses like restaurants to online services startups. Consult the SBA website for further details.

3. Invoice Factoring

Invoice factoring is a form of financing in which a business borrows capital upfront in exchange for selling its outstanding invoices to another institution which then performs collections.

In this way, they are monetizing what are effectively short-term loans they have made to vendors.

In return, the third-party institution charges a roughly 1-5% haircut to the collateral value.

Pros:

- No Need for Business Credit: Since factoring companies buy your invoices, they're more concerned with your customers' ability to pay than your business's credit history. This can be particularly beneficial for new startups without much financial history.

- Frees Up Cash: Factoring turns what you're owed from invoices or receivables into immediate cash, providing funds that were otherwise tied up. This cash can be used for daily expenses or to help grow the business.

- No New Debt: With factoring, you're not taking out a loan, so you're not adding any debt. You're simply getting paid sooner for work you've already done, without the obligation to repay the amount advanced.

Cons:

- Impact on Customer Relations: Having a third party step in to collect payments might not sit well with some of your clients. This could potentially harm your relationship with them and affect future business. It's important for business owners to think about how this might impact their customer relationships.

- Costs and Fees: The main downside is that you get less money upfront than the invoices are worth. For example, cashing in $100 of invoices early might only net you $80, which is like paying a very high interest rate for the advance.

4. Equipment Financing

Equipment financing refers to borrowing money against the value of equipment such as company vehicles, manufacturing machines, or even copy machines. In an equipment financing contract, borrowers raise capital from financial institutions with the promise that they will take ownership of equipment in case of default. This mitigates risk to the lender and can allow for lower interest rates.

Pros:

- Preserves Cash Flow: Equipment financing allows businesses to get needed equipment without a big upfront cost, keeping more cash available for day-to-day expenses.

- Tax Benefits: Businesses may enjoy tax advantages with equipment financing. Interest payments are often tax-deductible, and there can be additional tax incentives or depreciation benefits.

Cons:

- Cost of Capital: While it avoids a hefty upfront payment, equipment financing can end up costing more in the long run due to interest and fees. Businesses need to weigh the total cost against their budget.

- Asset Risk and Ownership: Until the financing is fully paid, the lender retains a claim on the equipment. Defaulting on payments could result in losing the equipment. Businesses wanting outright ownership may find financing less appealing.

5. Business Line of Credit

Think of a line of credit as a business's version of a credit card. It has priority over other debts for repayment, a predetermined spending limit, an interest rate, and penalties for late payments. It's a versatile financial tool that helps businesses smoothly handle periodic expenses, especially those that peak at the end of months, quarters, and years.

This financial instrument is essential for both small and large businesses, forming a critical part of their funding structure.

Pros:

- Access to Flexible Funds: Once set up, a line of credit offers businesses the flexibility to manage fluctuating expenses effectively. The funds are available as needed, similar to the function of a credit card.

- Building a Banking Relationship: Lines of credit are often viewed by banks as the beginning of a long-term business relationship. They may be priced favorably for the business, acting as a gateway to the bank's broader range of services and products. For borrowers, this can be an excellent way to access comprehensive banking solutions, including account and payment services, through an initial line of credit.

Disadvantages:

- Lengthy Approval Process: Getting approval for a line of credit from a bank can take time and involves thorough due diligence, including assessments by credit analysts, lawyers, accountants, and a lot of paperwork. This process can be particularly burdensome for startups.

- Credit History Requirement: Similar to applying for a bank loan, securing a bank credit facility necessitates a thorough credit evaluation. Banks look for a solid credit history to mitigate risk, which can pose a significant hurdle for early-stage startups lacking a financial track record.

6. Short-term Business Loans

Short-term business loans are most similar to traditional bank loans but with a shorter tenure. A traditional term loan might have a repayment period of 3-5 years, but a short-term business loan can be just months in duration.

These products can be a good fit for businesses looking for quick and short-term capital, perhaps in between larger rounds of Series equity financing.

Pros:

- Short-term commitment: Short-term business loans have shorter repayment dates vs. standard bank loans or permanent equity capital. This can be a good feature for startups as they do not lock into a form of financing that may not be the right long-term fit for their business.

- Speed to funding: Compared to series equity rounds which can take ~2 years between infusions, startups can secure funding more quickly with short-term business loans. This can help ease funding pressures between larger equity rounds.

Cons:

- Eligibility Restrictions: Bank loans typically come with strict eligibility criteria which may include collateral requirements and meeting financial and credit history stability hurdles.

- Higher Costs: Short-term business loans tend to have higher interest rates and fees, making them more expensive than longer-term financing options. This can strain a startup's finances.

- Cash Flow Pressure: The need for frequent repayments can significantly strain a startup's cash flow, especially if revenue is inconsistent, diverting funds from growth efforts.

- Impermanent funding source: Given their short-term nature, short-term business loans need to be repaid quickly. For a business looking for durable financing for long-term growth, it can be challenging to have to refinance frequently.

6. Merchant Cash Advance

Business or Merchant Cash Advances (MCA) provide businesses with an upfront sum of money in exchange for a portion of future sales, plus fees.

Pros:

- Adaptive Repayment: The repayment may be adjustable with daily credit card sales, meaning lower sales lead to smaller repayments, adding flexibility during slower business periods.

- Rapid Funding: MCAs offer quick access to cash, with a simpler and faster application process than traditional loans, ideal for immediate financial needs.

- Easier Approval: Approval for MCAs often depends on sales volume rather than credit history or collateral, making it easier for businesses to qualify.

Cons:

- High Cost: The total repayment, or factor rate, for an MCA can significantly exceed the original amount received, making it an expensive financing option.

- Reduced Profit Margins: If a percentage-based repayment model is elected, the daily sales percentage for repayments can cut into profits, which is crucial for growing startups to consider, as it may impact their operational efficiency. Businesses should evaluate their financial health and alternatives before opting for an MCA.

Startup Business Loan Requirements

In order to raise a startup business loan, startups will need to hit some or all of a suite of requirements from lenders.

Lending money to an early-stage business is a risky proposition, so banks and other lenders alike have a series of metrics they use to assess the risk of the business they lend to.

Let’s take a closer look at some of these requirements below. As a reminder, each lender and financial instrument is different, so you may not need to hit all of these requirements.

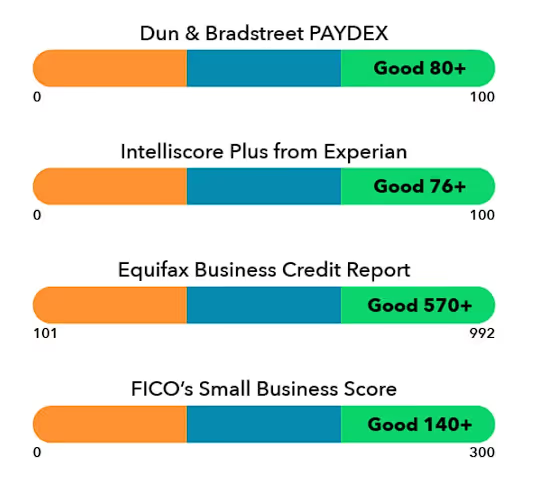

Credit Score

Credit scores are perhaps the simplest tools used to determine credit risk. In the United States credit scores are furnished by three credit bureaus: Equifax, Experian, and TransUnion.

In general, credit scores are calculated based on the history of successfully using and repaying loans per their terms. The scores can incorporate additional factors such as revenue and total assets.

Annual Revenue

Lenders will additionally look at the annual revenue generated by a business. One with healthy and growing revenues will be more likely to be able to service debt and repay their borrowing. This provides more peace of mind for the lender.

Business Plan

A thorough business plan is also an important component of being approved for a startup loan. Lenders will want to see that the borrower has put thought into their business venture and see a path to profitability and loan repayment.

Time in Operation / Age of Business

An additional factor in creditworthiness is operation time. Lenders will see how long your business has been running and what the performance has been over that time. A business that has been operating successfully (proving its business model and adapting to changes) for three years is more likely to execute its plan than one with only two weeks of operations.

Tips for Getting a Startup Business Loan

So you have done your research and determined a startup business loan is the right fit for you. How do you go about getting one? Let’s take a look at some tips below.

1. Manage Your Debt-to-Income Ratio

In a similar vein to the requirements discussed above, lenders evaluate credit risk using a number of factors. One key financial metric is debt-to-income ratio. It’s important to keep your debt-to-income ratio in check.

A business with a high debt-to-income ratio has a high debt load relative to their cash flow generation and thus has less cash flow to service additional borrowings. A lender will prefer to loan to a business with low borrowings relative to their earnings.

2. Demonstrate Cash Flow

Cash flow is also a key component of creditworthiness. Operating cash flows are the lifeblood of a business and can be used for capital expenditures to invest in future growth, marketing, and debt service.

A company with proven cash flow generation ability is more likely to be able to repay borrowings.

3. Offer Collateral

Another way to entice lenders to give you a startup loan is to offer collateral for your borrowings. An example may be a farmer offering their $200 K tractor as collateral for a loan.

This reduces the lender’s risk because if the farmer does not repay their loan, they can take ownership of the tractor and sell it to recover their principal.

4. Gather Required Documentation

Having all of your documentation (financial performance, legal documents, accounting information) organized and accessible for borrowers will make the process much more streamlined.

This can increase the likelihood of approval and reduce the time to funding.

5. Compare Lenders

Once you have determined the type and size of loan you would like, it is important to compare lenders (banks, alternative lenders, etc.) to determine who the right partner is for you as well as what the best financing terms are.

ECL is a trusted lending partner to many startups, having financed $30 million to date with over 70% of customers returning for additional funds. They offer affordable funds through their own $100 million debt facility. They offer revenue-based finance, which is finance on the basis of a company’s revenue.

This helps our customers turn their recurring earnings into upfront cash they can use right away. Getting an offer is quick–within 72 hours–and they finance companies up to $1.5 million.

More About Startup Loans

We have covered many of the key points around startup loans above. Still have questions? Let’s take a look at some frequently asked questions below.

Can a startup get a bank loan?

Yes, but not all startups. Bank loans require more operating history, financial performance, and other factors as compared to alternative lending sources, for approval.

Startups are turning to other sources such as alternative financing, which can be more flexible and a better-fit for their business.

Do startups take out loans?

Yes, startups can and do take out loans during all stages of growth. Loans, or non-equity financing generally, can offer both increased flexibility and lower cost of capital and are also non-dilutive.

Which loan is best for startup businesses?

Startup companies usually have limited operating or credit history, and limited collateral, making it challenging to secure traditional financing such as lines of credit or bank loans.

This is why revenue-based financing is a great option for startup businesses: lenders can look at a short window of revenue history and future projections to make the offer. Plus, its non-dilutive nature, no accumulation of interest, speed of funding, and affordability all make it a great fit for startups.

How can you finance a startup?

You can finance a startup in many ways, generally categorized across equity, debt, and alternative financing structures. Each type of financing carries a different cost of capital and characteristics.

Can you get a startup business loan with no revenue?

Yes, you can get a startup business loan without revenue. In the past, banks used to have stringent requirements to be approved for a loan, restricting access to capital. However, markets such as the SBA and alternative financing spaces have stepped in to address this gap and facilitate the flow of capital to businesses.

It is important to understand your business and the options available to you before taking out a startup business loan.

Access The Best Startup Financing

Startup financing is a key component of growth and long-term business success. The best type of startup financing (across the equity, debt, and alternative financing spectrum), is the one whose distinct pros and cons are the best fit for your business.

Founders are encouraged to partner with financial professionals in order to perform a full analysis and determine the best type of startup financing.

If you’re a revenue-generating startup and looking for affordable, quick funding to help reach your growth goals, work with Efficient Capital Labs.

ECL is unique for a few reasons: it uses its own $100M debt facility to provide funding, meaning they can offer lower fees and a more dependable service. ECL also understands that startup companies often generate revenue in multiple countries, so they offer funding based on your total revenue from around the world–not just in one geography.

Ready to turn your recurring earnings into upfront cash you can use right away?