Recur Club Review & Top Alternatives [2026]

![Recur Club Review & Top Alternatives [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/67366e2019138650f7d5293a_65e64879cd7a95ad96759419_recurclub%20Cropped.avif)

2 mins

sheet terms alone. It requires examining how potential partners philosophically align with your startup's spirit and priorities across unpredictable futures.

As a startup, maximum growth begins with financing relationships. Often, that means trading equity in exchange for startup capital. But with revenue-based financing, you don’t have to give out equity for capital.

This Recur Club review will examine their financing model's incentives and customer experience.

Is revenue-based financing for you? How effective is it for startups? And is Recur Club the best option, or are there better alternatives?

Let’s begin.

What Does Recur Club do?

Founded in 2021, Recur Club is an India-based revenue-based finance company. They operate an online automated platform for recurring revenue financing exchange between growth-stage companies and institutional capital providers.

Their model aims to offer founders up to 50% of annual recurring revenue through flexible capital infusions linked to predictable subscription income streams.

How does revenue-based financing work?

Revenue-based financing (RBF) offers companies access to growth capital based on future recurring revenue. RBF can provide you the capital upfront, with you repaying a fixed amount over a set time frame until the capital is recouped.

For example, let’s say the lender offers a fixed fee of 10% on a principal of $500,000. Each month, you pay back an equal fraction of both. So since the principal plus the fee is equal to $550,000 and the term is 12 months, then each month you pay back $550,000 / 12. In other repayment models, payments are made each month as a percentage of the company’s monthly revenues.

Recur Club Review

Let's analyze if Recur Club's flexibility incentives translate into reality across important aspects like customer experience, risk management, and incentives beyond fast financing.

How does Recur Club work?

Recur Club markets itself as a future revenue exchange, matching Indian companies with capital providers through proprietary algorithms and APIs.

First, qualified companies connect accounting and financial data to Recur Club’s platform. After evaluation, they receive offers backed by Recur Club's external network of capital partners. These six partners help deploy the capital which can sometimes require external approval outside of the AI-based evaluation.

Approved companies receive non-dilutive funding. To repay the funding, they commit to repay fixed percentages of future revenue on a monthly basis to Recur Club over adjustable 6-24 month terms. These daily/monthly amounts owed fluctuate proportionately to actual sales figures. Strong performance accelerates repayment, while slowdowns in sales decrease the speed of repayment.

Recur Club Founder & CEO

Recur Club was founded by Abhinav Sherwal, co-founder and co-CEO, along with other members of IIMs, IITs, BITS, KJ Somaiya, and NSIT alumni. They’ve raised around $30 million across three rounds of funding.

Recur Club Products & Offerings

Recur Club offers flexible "revenue advances" tied directly to companies' predictable subscription income. Recipients access upfront cash, giving them access to customized capital amounts on-demand as needed. These are repaid through fixed daily/monthly percentage revenue shares over adjustable 6-24 month horizons until repaying the principal amount.

Additionally, they provide up to 20 crore ($2.4 million USD) to companies with recurring revenue — typically SaaS. To be eligible for funding, you need a minimum of $100,000 ARR, greater than one year vintage, and greater than three months runway.

Key features include non-dilutive funding up to 50% of annual recurring revenue with no caps, personal guarantees, or usage restrictions. Recur Club's proprietary algorithms leverage integrated accounting data to match offers between institutional investors and customers based on risk profiles on both ends.

Recur Club Pros & Cons

Pros:

- Quick access to capital

- Revenue-aligned repayments ease cash flow

- Preserves ownership equity and control

- Platform matches offerings to institutional investor risk tolerance

Cons:

- Marketplace approach means that funding availability and reliability is dependent on Recur Club’s external capital partners

- Lack of public data on durable viability

- Vetting required on post-reconciliation clauses

- Funding only available in INR and to India-based companies

Recur Club Reviews

There aren’t too many online reviews of Recur Club. Currently, the only reviews available are on Recur Club’s website as well as on G2.com.

Out of the few reviews online, most were positive. However, one user pointed out that the line of credit offered by Recur Club could be more flexible, indicating that adjustable repayment terms might favor Recur Club over customers.

So if you’re looking for hyper-flexible funding, you might want to consider some Recur Club alternatives.

Recur Club Alternatives At-a-Glance

Here’s an at-a-glance comparison chart of some great GetVantage alternatives to consider - with a focus on those serving the Indian market:

Top Alternatives to Recur Club: Complete Overview

Understanding your range of revenue financing options in the ecosystem ensures your startup discovers the provider best enabling your growth objectives. Beyond Recur Club, here are key players in the Indian revenue-based financing space delivering non-dilutive capital.

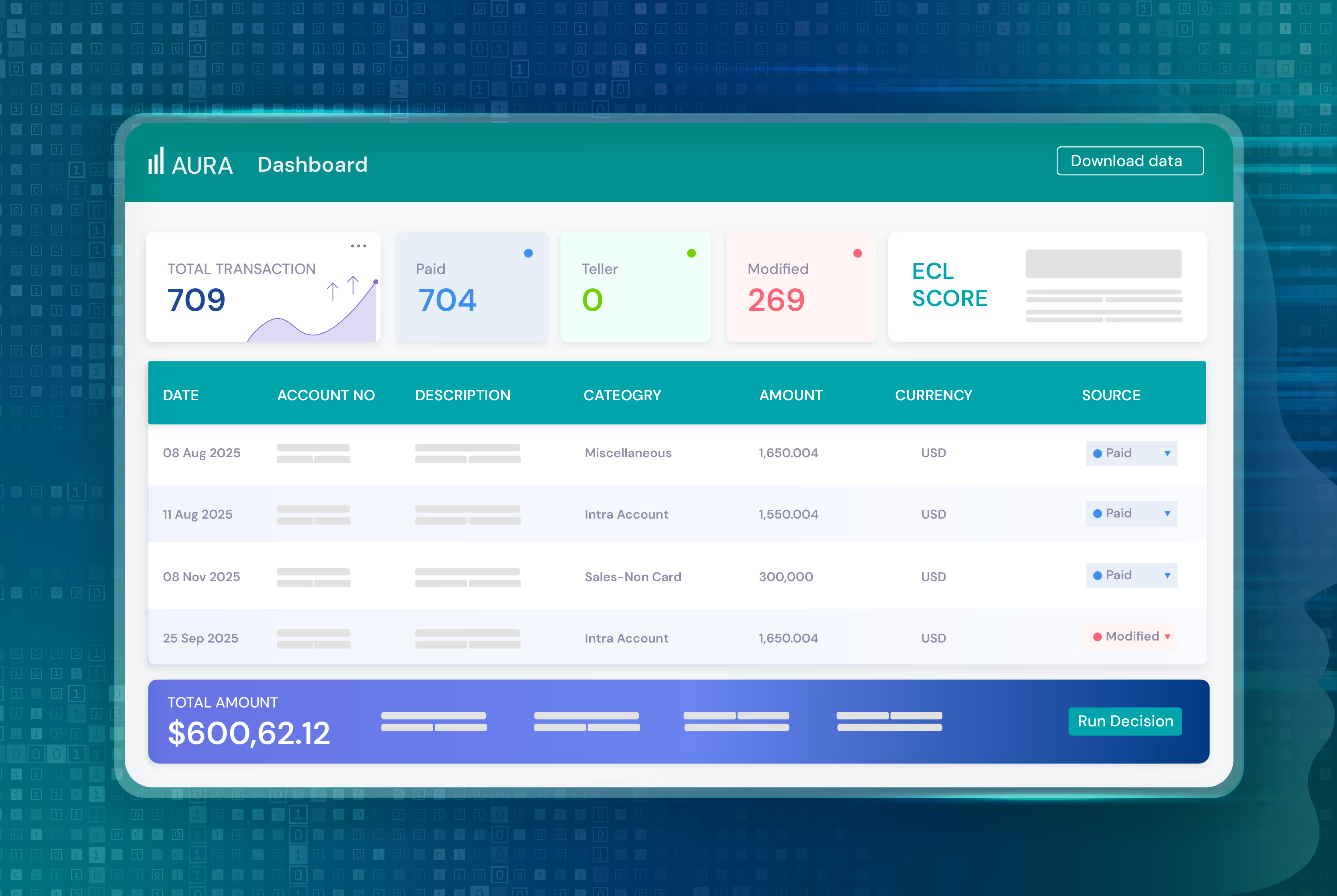

1. Efficient Capital Labs

Efficient Capital Labs (ECL) is a company that finances high-growth companies, ranging from bootstrapped startups to scaling SaaS ventures.. They provide B2B SaaS startups with non-dilutive capital covering up to 65% of annual recurring revenue.

ECL funds companies around the world, including entities in India and USA, and companies can mix and match funding in both INR and USD to match their cash flow needs. ECL provides growth capital to companies operating in the global market, including many cross-border startups. Customers typically use the funds for hiring, marketing, entering new markets or as bridge financing to a next venture capital round.

By giving you a fixed upfront rate between 12% and 15% (for INR lending), all you need to focus on is growth. Each month, you’ll repay a fixed amount toward your funding based on a 12-month repayment plan so you know exactly what your fixed costs will be upfront.

Products & Offerings:

- Non-dilutive cash advances up to $1.5M

- Transparent financing fees of 10-12% (USD) and/or 12-15% (INR) financing

- 12-month repayment terms

- Funds within three days that are powered by their own $100M capital facility, allowing them to offer the lowest fees

With ECL, there are no hidden fees that you need to worry about, and you can get capital within three days—the fastest on the market.

2. Klub

Klub offers emerging companies flexible revenue-based growth financing for goals ranging from inventory to marketing to expansion needs. Their core facilities advance amounts from $67K up to $4M+ over 9-18 month adjustable repayment terms aligned to daily or monthly sales.

Recipients repay a multiple of the capital deployed until full repayment of the capital and fees.

Products & Offerings:

- $67K to $4M limits

- 9-18 month aligned terms

- Funding in 1-2 weeks

3. Velocity

Velocity supplies revenue-based financing to digital firms seeking capital minus dilution. They fund cases spanning inventory, advertising, hiring, or new market entry objectives. Velocity advances range from $13K to $400K tied to 5-10% of future sales over 6-24 month durations until recouping 1.5X the amount.

Approvals and cash disbursals are often completed in one week.

Products & Offerings:

- $13K to $400K limits

- 6-24 month repayment terms

- 7-day financing

4. GetVantage

GetVantage supplies digital merchants, D2C retailers, and SaaS startups with revenue-based financing options aligned to diverse vertical needs spanning inventory enhancement to growth capital raises. Financing offers various repayment horizons and percentage of revenue-share as a required repayment, which allows repayment to adjust to individual customer circumstances over time.

Matching between the capital providers and customers happens via data analytics. GetVantage aggregates third-party funding with independent policies, so there are limits on singular control.

Products & Offerings:

- ₹5 lakhs to ₹4+ crore limits

- 5-25% revenue share options

- Fixed-term scheduling

5. N+1

N+1 Capital provides Revenue-Based Growth Capital to companies across early to established stages. Funding can be used towards hiring, inventory purchases, expansion objectives, or other growth goals linked directly to predictable future income streams.

N+1 advances amounts ranging from $134K to $1.5M+ USD, with limits scaling up to 4X average monthly sales. Firms repay capital by sharing a fixed 2-9% sales percentage until reconciling.

Products & Offerings:

- $134K to $1.5M+ limits

- Repayment aligns with revenue

- Continuous capital access

The Bottom Line on Recur Club

A sustainable partnership needs transparency with fixed variables – with no hidden fees or confusing repayment structures. That way, you can scale up or down according to your fixed costs.

For B2B SaaS firms seeking runway support grounded in transparency and speed, Efficient Capital Labs proves the prudent choice. ECL’s own $100M debt facility ensures the reliability and availability of funding - a reason that over 70% of ECL’s customers return for additional funding.

With a global risk model, cross-border ventures can quickly access both USD and INR with ECL – with more currencies coming soon.

- Raise non-dilutive capital in 72 hours

- Clear fees ranging between 10%-12% for USD and 12%-15% for INR

- Easy 12 months repayment plan

No hidden fees. No hassle.

Get frictionless, transparent financing for your startup at ecaplabs.com.

![Recur Club Review & Top Alternatives [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/675733c091a90dab102096fc_ecl-madeline.avif)